What is CDMS and who is it meant for?

The Certificate in Derivatives Market Strategies (CDMS) is an advanced level certificate in Derivatives. It is an asset for a wide range of securities industry careers. It is an excellent means to gain an edge when applying for or advancing in roles that use derivatives such as:

- Trading Desk Professionals

- Investment Advisory Roles

- Institutional Sales

- Research Analysis

- Risk Management

- Conventional and Alternative Portfolio Management

- Structured Product Development

- Treasurer Roles

What are the benefits of the CDMS certification?

Upon completion, you will be able to:

- Demonstrate an advanced, global standard in developing strategies using derivatives while raising professional standards

- Extend your knowledge of exchange-traded derivatives’ products and enable yourself to introduce Over the counter (OTC) derivatives and their various product characteristics and applications

- Gain an in-depth understanding of the various underlying markets that the key derivative instruments are based on and are frequently used in

- Use the skills to unravel the technical complexities of derivatives into actionable knowledge that can be immediately applied in your current role or assist your career progression

Is CDMS a known certification?

The CDMS is an established and credible global certification

brought into India by the National Institute of Securities

Markets (NISM) in collaboration with Moody’s Analytics.

How can I enrol in the CDMS proctored examination?

Every quarter the candidates will be sent the dates of the CDMS proctored examination along with a physical copy of the form. If the candidate is interested in appearing for the CDMS proctored examination, he/she will have to fill in the form and send a scanned copy of it to NISM. Thereafter, NISM shall check if the candidate has fulfilled the pre-requisites for the CDMS examination and accordingly enrol the candidate for the examination and communicate the same to him.

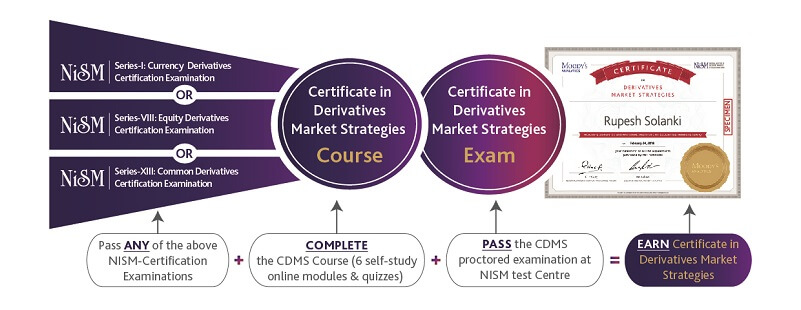

What are the Pre-requisites to write the CDMS proctored examination?

You must complete one of the NISM Derivatives Examinations and each of the CDMS modules, then you will gain access to write the CDMS proctored exam.

What are the modules that comprise the CDMS course?

- Introduction to Derivatives

- Underlying Markets

- Pricing of Derivatives

- OTC Derivatives

- Advanced Trading Techniques Using Derivatives

- Advanced Hedging and Product Construction Techniques Using Derivatives

Can I purchase the modules individually or do I have to purchase them all together at the same time?

You can purchase them individually over time or all at once.

Is it compulsory to appear for the CDMS proctored examination?

To earn the Certificate in Derivatives Market Strategies an individual must complete the pre-requisites and the proctored CDMS examination. Students, however, who are just seeking specific derivatives knowledge can choose to just complete one or several modules, depending on their area of interest. These students will receive a Notice of Course completion for each module they complete, but will not earn the full CDMS.

What is the assessment structure for the CDMS exam?

CDMS is a proctored computer-based 3-hour examination. The exam consists of 60 application-based questions. The passing mark for the CDMS examination is 36 marks. This is no negative marking.

When and where can I appear for the CDMS proctored examination?

After completing the pre-requisites, you can register for the proctored examination with NISM. The exams are held at designated NISM test centres.

For how long can I access the CDMS study material on the Learning Management System?

The modules will be available for a 2-year period after the purchase of the first module or the complete set of modules. You must complete the CDMS proctored exam within this 2-year period.

What is the mode of studying for the CDMS course?

The eLearning self-study modules are available through the Learning Management System (LMS).

Do I get recognition for completing each of the modules?

Yes, you will get a Notice of Module completion from Moody’s Analytics and NISM after completing each of the online modules (whether you buy the modules individually or as a package).

What is the validity period for the CDMS?

The Certification in Derivatives Markets Strategies (CDMS) is valid for life.

Will I get a certification after completing the CDMS?

If you successfully pass the CDMS proctored examination and attain a score of 60 percent or more, then you will be awarded the CDMS certification and receive a wall certificate that will be emailed to you.