Second Annual Capital Markets Conference 2021 on “Investors Interest and Innovative Instruments”

(July 22-23, 2021 | Sponsored by SBI & Co-sponsored by JAFEE)

The School for Securities Information and Research (SSIR) has successfully conducted the two days Second Annual Capital Markets Conference 2021 during 22-23, July 2021 on “Investors Interest and Innovative Instruments” sponsored by State Bank of India and Co-Sponsored by the Japanese Association of Financial Econometrics and Engineering (JAFEE).

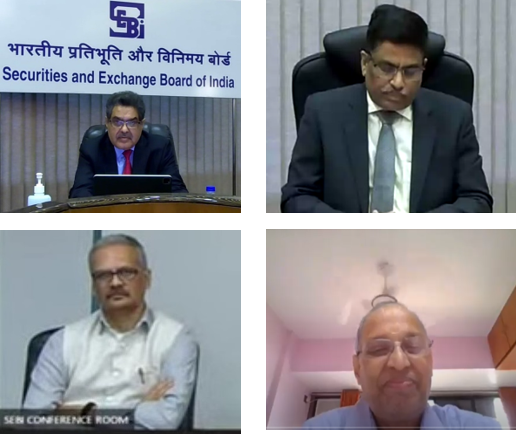

The conference was inaugurated by Hon’ble Securities and Exchange Board of India (SEBI) Chairman Shri Ajay Tyagi. Shri Tyagi briefed about the innovations in the financial markets, instruments, and how SEBI is taking care of the interest of the investors. The opening remarks of the conference was given by Dr. V.R. Narasimhan, Dean, NISM. The Director, NISM, Shri Santosh Kumar Mohanty has given the welcome address to all the participants followed by vote of thanks by Registrar, NISM, Shri Sunil J. Kadam.

The conference has received 114 research papers from India (IIMs, IITs, Central and State Universities, along with eminent autonomous institutions) and Abroad (USA, France, Kazakhstan, Dubai, China, Australia and others). All the papers received by the conference has gone through a blind review process and finally 17 papers got accepted for presentation in these two days’ conference and has been presented in 6 technical sessions. The 17 papers cover topics viz., Mutual Funds, Commodity Markets, Stock Market effectiveness, Regulatory effectiveness (buy back and insider trading) and even a paper on impact of work from home. For each of the papers presented, there was a discussant to give valuable comments to develop the paper.

The conference has tied up with two journals to publish selected papers. One is the Asia Pacific Financial Markets (ABDC, and Scopus listed) and the other one is the FIIB Business Review (Scopus Listed). The conference has awarded three best prizes to four papers with cash prizes. The award winning papers along with the cash prize are given below

| Prize | Name and Organisation of the Author/s | Paper Title |

|---|---|---|

| 1st Prize | Sobhesh Kumar Agarwalla, Ajay Pandey, Sumit Saurav & Jayanth R. Varma, Indian Institute of Management Ahmedabad | Effect of Continuous Disclosure Requirement on Information Leakage Around Earnings Announcements |

| 2nd Prize | Pranjal Srivastava, Jacob Joshy & Ajay Pandey, Indian Institute of Management Ahmedabad | A minimum buyback requirement in open market repurchases: Impact on the signalling role |

| 2nd Prize | Sanjay Mansabdar & Hussain Yaganti, BITS Pilani, Hyderabad Campus | Optimizing hedging effectiveness of Indian agricultural commodity futures – a simulation approach |

| 3rd Prize | Gabriele Lattanzio, Nazarbayev University, Kazakhstan | Does the Stock Market Fully Value Alternative Work Arrangements? Work From Home and Equity Prices |

The conference also has invited speaker sessions on “The art of publishing in a Finance Journal” and another on the “Market Microstructure of Nepal Markets”.

The valedictory address was given by Dr. Abhaya Pethe, Chairman Academic Council, NISM and Dr. N. R. Bhanumurthy Vice-Chancellor, BASE University.