Post Graduate Diploma in Management (Securities Markets) – PGDM (SM)

About the Program:

PGDM (SM) is an AICTE approved two-year Post-Graduate Diploma Programme in Management, where the students get exposure to varied subjects and verticals of securities markets including Economics, Financial Statement Analysis, Corporate Finance, Portfolio Management, Equity Valuation, Fixed Income Securities, and Derivatives & Risk Management, Investment Banking, Mutual Funds, and Wealth Management, benchmarked with the best and contemporary texts. Post Graduate Diploma in Management (Securities Markets) – PGDM (SM)

The carefully crafted curriculum, along with application-based teaching pedagogy and industry internship, serves as a strong foundation for further grooming and growth into various career paths in the corporate/financial/securities markets. PGDM (SM) students are positioned to take up a wide range of roles and responsibilities, such as Analysts, Investment Managers, Investment Bankers, Treasury Managers, Risk Managers, Compliance Officers, Financial Planners, Wealth Managers, etc.

Where does PGDM(SM) lead to?

PGDM (SM) can lead the successful participants to the following careers pathways. Some illustrative career opportunities available for PGDM (SM) graduates are as under:

- Segments: Equity Markets, Debt Markets, Currency and Currency Derivative Markets, Commodity Derivative Markets

- Market Infrastructure Institutions: A wide range of roles (Business Development, Operations, Compliance, Risk Management, etc.) in Market Infrastructure Institutions including Stock Exchanges, Commodity Exchanges, Clearing Corporations and Depositories

- Research and Analytics: Credit Research & Ratings, Economic Research, Policy Research, Analytics and Computing in Risk Management & Derivatives

- Banking: Commercial banking, Treasury Operations, Treasury Management, etc.

- Advisory: Investment Advisor, Personal Financial Planner, Wealth Manager

- Mutual Funds: Business Development, Distribution, Operations, Compliance, Risk Management, etc. in the Mutual Funds Industry

The objective for designing a programme of the status of a Post Graduate Diploma is “to create complete securities market professionals”. Since the field of securities markets represents the confluence of several related areas, the post-graduate programme in securities markets rests on the following pillars:

- Economics, including financial economics

- Finance

- Accounting and Reporting

- Quantitative Methods and Computing

- Law and Compliance

- FinTech

Each of the above-mentioned fields is fully represented in the proposed programme, with a balance between elegance and rigour. Based on SSE’s prior experience, but also after infusion of fresh thinking, the architecture of the PGDM (SM) has been conceived. Each course is benchmarked with the best-in-class textbook (recommended text) to arrive at the chosen content.

Design and Curriculum

The programme has a globally benchmarked curriculum deliberated by a council of academicians and market practitioners. Divided into six trimesters, the curriculum is designed to provide research-based inputs and industry insights through a team of academicians and market experts.

| Subject Code | Trimester – I | Hours | Credits |

|---|---|---|---|

| 101 | Economics for Securities Markets | 30 | 3 |

| 102 | Financial Reporting | 30 | 3 |

| 103 | Financial Institutions & Markets | 30 | 3 |

| 104 | Mathematics for Securities Markets | 30 | 3 |

| 105 | Statistics for Securities Markets | 30 | 3 |

| 106A | Organisation Behaviour and Management | 15 | 1.5 |

| 106B | Excel Skills for Management | 15 | 1.5 |

| Summer Internship (Summer 2026) | |||

|---|---|---|---|

| Summer Internship | 6 | ||

| Subject Code | Trimester – II | Hours | Credits |

| 201 | Financial Statements Analysis | 30 | 3 |

| 202 | Corporate Finance | 30 | 3 |

| 203 | Business Communication | 30 | 3 |

| 204 | Corporate and Allied Laws | 30 | 3 |

| 205 | Financial Analytics | 30 | 3 |

| 206 (A) | Smart Lab I | 15 | 1.5 |

| 206 (B) | Mutual Funds | 15 | 1.5 |

| Summer Internship (Summer 2026) | |||

| Summer Internship | 6 | ||

| Subject Code | Trimester – III | Hours | Credits |

| 301 | Securities Analysis and Equity Valuation | 30 | 3 |

| 302 | Securities Market Laws and Regulations | 30 | 3 |

| 303 | Fixed Income Securities | 30 | 3 |

| 304 | Fintech in Financial Markets | 30 | 3 |

| 305 | Derivatives & Risk Management-I | 30 | 3 |

| 306 (A) | Marketing of Financial Products & Services | 15 | 1.5 |

| 306 (B) | Research Methods and Data Analytics | 15 | 1.5 |

| Academic Courses: 2026-2027 | |||

|---|---|---|---|

| Subject Code | Trimester – IV | Hours | Credits |

| 401 | Fixed Income Securities | 30 | 3 |

| 402 | Derivatives & Risk Management II | 30 | 3 |

| 403 | Portfolio Management | 30 | 3 |

| 404 | Treasury Management | 30 | 3 |

| 405 | Market Infrastructure Institutions | 30 | 3 |

| Subject Code | Trimester –V | Hours | Credits |

| 501 | Corporate Restructuring and Valuation | 30 | 3 |

| 502 | Commodities Markets | 30 | 3 |

| 503 | Financial Planning & Wealth Management | 30 | 3 |

| 504 | Financial Modelling & Research Report Writing | 30 | 3 |

| 505 (A) | Smart Lab – II | 15 | 1.5 |

| 505 (B) | Investment Banking | 15 | 1.5 |

| Subject Code | Trimester – VI | Hours | Credits |

| 601 (A) | ESG Factors and responsible investing | 15 | 1.5 |

| 601 (B) | Forex Markets and International Finance | 15 | 1.5 |

| 602 (A) | Alternate Investment Funds | 15 | 1.5 |

| 602 (B) | Taxation for Securities Markets | 15 | 1.5 |

| 603 | Project Dissertation (Off Classroom) | – | 6 |

| 604 | Professional Certifications (Off Classroom) | – | 6 |

| Total 108 | |||

| Sr. No. | Embedded NISM Certifications |

|---|---|

| 1 | NISM Series V A: Mutual Fund Distributors Certification Examination |

| 2 | NISM Series VII: Securities Operations and Risk Management Certification Examination |

| 3 | NISM-Series-X-A: Investment Adviser (Level 1) Certification Examination |

| 4 | NISM-Series-VIII: Equity Derivatives Certification Examination |

| 5 | NISM Series-IX: Merchant Banking Certification Examination |

| 6 | NISM Series-XV: Research Analyst Certification Examination |

Important points:

SStudents need to complete the mandatory certifications within the deadlines indicated by the Program office.

The examination fee for the aforementioned mandatory certifications is not included in the program fee of PGDM (SM). Students will have to appear and pass all examination on their own. A student will earn 6 program credits (as part of Course ‘604 Professional Certifications’) on successful completion of all six mandatory certifications.

Embedded Workshops

In addition to the courses and certifications listed above, the program will be continuously enriched further through focused advanced workshops and sessions from industry speakers and alumni. The workshops to be organized for the batch would be predominantly identified based on the recruiters’ feedback, the industry feedback, and the contemporary developments in the securities markets landscape. The following are some of the indicative topics on which workshops would be organized for the batch:

- a) Equities Research

- b) Credit Risk Analysis

- c) Compliance function at MIIs and other intermediaries

- d) Surveillance and Risk Management functions

- e) Treasury Operations at Banks

- f) Private banking and Wealth management

- g) Algorithmic and High frequency trading

- h) Quantitative applications in securities markets

- i) Data Science Applications in securities markets

- j) REITs, InVITs and Alternate Investments

- k) Other area(s), as needed, based on the industry feedback and contemporary developments

Eligibility Norms

| Educational Qualifications | Valid Common Entrance Test Score |

|

1. Applicant must possess a strong and consistent academic background. Performance in 10th grade, 12th grade and every year of graduation are considered in the selection process.

2. Passed Bachelor’s Degree of minimum 3 years’ duration and obtained at least 50% marks (45% in case of candidates belonging to reserved category) in any stream.

3. Applicants in the last year of their bachelor’s degree program and awaiting their final results can also apply. However, their admission will be considered as provisional and is subject to fulfilling the above mentioned eligibility criteria within the specified timeframe. |

The candidates are required to qualify in anyone of the six all India Common Admission Tests i.e. CAT, XAT, CMAT, ATMA, MAT, GMAT or MH-CET (Management) in Maharashtra. |

Note: Candidates whose competitive exam results are not officially announced can also submit the application form. However, candidate has to submit the competitive exam score to NISM Admission office once the results are announced, until then the admission will be stated as provisional.

Selection Procedure

Selection shall be based on the educational qualifications of the candidate, competitive exam score and Personal Interview (PI). Provisional admission offered to selected candidates, who do not pay the fees on or before the stipulated date would automatically stand cancelled.

How to apply?

Candidates are required to register themselves online on https://apply.nism.ac.in/pgdm/

Step 1: New Registration: Upon successful registration, a User-ID and Password will be sent to registered email ID and mobile number of the candidate.

Step 2: Fill the Application form and upload all relevant documents.

Step 3: Pay the application fee of ` 1000/- (One thousand only) and other applicable charges.

Programme Fee

| Fee Structure of PGDM (SM) 2025-27 | ||||

| Particulars | 1st Installment | 2nd Installment | 3rd Installment | 4th Installment |

| Tuition fee | 1,38,000 | 1,38,000 | 1,38,000 | 1,38,000 |

| Library fee | 10,000 | 10,000 | 10,000 | 10,000 |

| Exam fee | 5,000 | 5,000 | 5,000 | 5,000 |

| Alumni fund | 2,000 | – | – | – |

| Total Program fees (A) * | 1,55,000 | 1,45,000 | 1,45,000 | 1,45,000 |

| Library Deposit – Refundable (B) | 10,000 | – | – | – |

| Total fees including Refundable deposits (A + B) | 1,65,000 | 1,45,000 | 1,45,000 | 1,45,000 |

| Gross Total |

6,00,000 |

|||

| Due Date | Within seven days of receiving offer letter

|

November 01, 2025

|

June 15, 2026

|

November 01, 2026

|

Fee Refund Policy

If a student chooses to withdraw from the program of study in which he/she is enrolled, the institute will follow the following three-tier system for the refund of fees remitted by the student.

| Sr. No | Refund Amount | Point of time when notice of withdrawal of admission is served to the Institute |

| 01 | The fee paid will be refunded after a flat deduction of Rs. 1,000/- | Before commencement of the programme or July 15, 2025 whichever is earlier |

| 02 | The fee paid will be refunded after a flat deduction of Rs. 10,000/- | After July 15, 2025 and the vacant

seat is filled by another student from wait list. |

| 03 | The student will not be eligible for any refund, except the refund of the refundable deposits included in the fees | After commencement of the programme or after July 15, 2025, and the seat remained vacant. |

Hostel Facilities

Comfortable hostel accommodation, separate for boys and girls, is available in the campus. The hostels are well equipped with all the modern amenities and are under the charge of caring and experienced Wardens.

-

Mess and Cafeteria: A spacious well lit and well ventilated cafeteria in the campus serves sumptuous and healthy food to the students. The variety of dishes which are both healthy and tasty and are crafted by a team of professional dieticians to ensure a well-balanced diet.

-

Diverse Sports Facilities: NISM has a world class sports complex and extensive sports facilities. NISM offers ample opportunities to students for a regular work-out and lifestyle management by providing a host of excellent sports facilities. It has facilities for games like cricket, basketball and volleyball as well as indoor games like chess, carom, table-tennis, badminton, etc. A Gymnasium and a swimming pool is also available for students to enhance their fitness levels.

-

Medical Facilities to ensure students well-being: NISM provides basic medical facilities within the Campus. Ambulance facility is also available in the Campus in case of any emergency.

-

Limited laundry facilities are available on payment basis at our campus.

Hostel fees

|

Fee Structure for students opting for Hostel Accommodation |

||||

|

Particulars |

First Instalment |

Second Instalment |

Third Instalment |

Fourth Instalment |

|

Hostel Charges # |

42,000 |

42,000 |

42,000 |

42,000 |

|

Food Charges |

31,500 |

31,500 |

31,500 |

31,500 |

|

GST on Food (5%) |

1,575 |

1,575 |

1,575 |

1,575 |

|

Total Hostel & Mess Fee (A) |

||||

|

Hostel Deposit – Refundable (B) |

10,000 |

– |

– |

– |

|

Total fees including Refundable deposits (A + B) |

85,075 |

75,075 |

75,075 |

75,075 |

|

Due Date |

Within seven days of receiving offer letter |

01- Nov- 25 |

15-Jun-26 |

01- Nov- 26 |

# Twin Occupancy non AC accommodation. However, AC will be provided in the month of March, April and May.

The hostel charges mentioned above are towards Twin Occupancy and Non-AC accommodation

Important Dates

| Start Date of Application | April 26, 2025 |

| Last date of application | June 15, 2025 |

| Commencement of Admission Interviews | Will be intimated separately |

| Declaration of Merit List | June 30, 2025 |

| Commencement of Program |

Application closed |

* The Management reserves the right to change, amend programme structure and fees as when it deems fit.

NISM PGDM(SM) Admission 2025-27

Frequently Asked Questions

Q1. What is NISM PGDM(SM) Program?

Post Graduate Diploma in Management (Securities Markets), a 2-year AICTE-approved full-time program by NISM focusing on the securities markets.

Q2. What are the Academic Eligibility Criteria for the PGDM(SM)?

Graduation:

- Applicant must possess a strong and consistent academic background. Performance in 10th grade, 12th grade, and every year of graduation is considered in the selection process.

- Passed Bachelor’s Degree of minimum 3 years’ duration and obtained at least 50% marks (45% in case of candidates belonging to reserved category) in any stream.

- Applicants in the last year of their bachelor’s degree program and awaiting their final results can also apply. However, their admission will be considered as provisional and is subject to fulfilling the above-mentioned eligibility criteria within the specified timeframe.

Appearance in Competitive Examinations: Candidates are required to qualify in any one of the following: CAT, XAT, CMAT, ATMA, MAT, GMAT or MH-CET (Management). (Passing year -2025)

Note: Candidates who have appeared in MAT & ATMA after Jan 2025 are also eligible and their score cards are valid. Admission is provisional until all required results are submitted.

Q3. Those who are in last year and are waiting for final results, can they apply?

Yes! Admission will be provisional till graduation marks are submitted.

Q4. Who should apply for PGDM(SM)?

The program is ideal for students pursuing graduation in Economics, Commerce, Finance, Engineering, or Management aspiring for a career in capital markets.

Q5. What is the Selection Process of NISM for PGDM(SM)?

- Overall Academic Performance

- Competitive Exam Score

- Personal Interview (Virtual)

Q6. How many seats are available in the PGDM(SM)?

There are 120 seats in the PGDM (SM) program.

Q7. Is distance learning or online available for PGDM(SM)?

No! The program is not offered in distance or online mode.

Q8. How can I apply?

Register online at https://apply.nism.ac.in/pgdm

- New Registration: Receive User-ID and Password via email/SMS.

- Login and complete application with ₹1000/- fee payment.

Q9. What is the application form fee?

₹1000/- + applicable charges via Debit/Credit Card, Net banking, or UPI.

Q10. What leads most students to choose this college?

- Expert faculty with securities market knowledge

- Strong infrastructure

- Established by SEBI

- Simulation lab for stock trading

- Blend of faculty from academia, industry, and regulators

- Regular industry interaction

Q11. May I visit the campus? If so, when?

Yes, Monday to Friday, 10:00 AM – 4:00 PM. Email apu@nism.ac.in to schedule. See campus details: NISM Campus

Q12. What subjects are covered in the PGDM(SM) program?

The program includes embedded NISM certifications:

- NISM-Series-VII: Securities Operations and Risk Management

- NISM-Series-XA: Investment Adviser (Level 1)

- NISM-Series-V-B: Mutual Fund Distributors

- NISM-Series-VIII: Equity Derivatives

- NISM Series-IX: Merchant Banking

- NISM Series-XV: Research Analyst

Financing your PGDM(SM)

Q13. What is the estimated cost for two year PGDM(SM) at NISM?

Program fee: ₹6.00 lakhs

Hostel & mess: ₹3,10,300 approx (2 years)

Fee payable in four installments.

Q14. What are some options for financing my PGDM(SM) education?

NISM is enlisted on VidyaLakshmi Portal for education loan applications.

Q15. Any scholarship scheme is available for students?

- Merit Scholarship: 50% tuition fee waiver (Year 1)

- Economically backward & meritorious students: 50% waiver (Term 1)

- Local area students: 30% waiver

- Best performing students: Up to 50% waiver

- Admission merit: 50% waiver with 1st class degree + 75+ percentile in CAT/XAT/GMAT

- SC/ST and Backward Class students: 50% waiver

- Children of SEBI registered entity employees: 30% waiver

- Children/Spouses of SEBI/NISM/outsourced staff: 40% waiver

- Other test scores (80 percentile+): up to 50% waiver

PGDM(SM) Placement

Q16. Where do PGDM(SM) students get placed?

Placement profiles include: Treasury, Advisory, Merchant Banking, Compliance, Corporate Banking, etc. Recruiters include Banks, Stock Exchanges, Depositories, Mutual Funds, etc.

Q18. Name of the Past recruiters?

ICICI Bank, SBI MF, STCI, BSE Ltd., Federal Bank, Axis Trustees, IFA Global, IDBI Bank, NSDL, and more.

Q19. What is the placed Student CTC?

Average: ₹9.07 LPA

Maximum: ₹16.32 LPA (based on performance)

Q20. What are the key dates for admission?

- Application Opens: April 26, 2025

- Deadline to Apply: June 15, 2025

- Interviews: Tentatively from first week of June 2025

- Merit List: June 30, 2025

- Program Starts: July 15, 2025

For any further enquiries, please connect to the admission helpdesk NISM: 08268002412

Placement Report 2020-2022

Executive Summary

The NISM Campus placement drive started from December 1, 2021 for Post Graduate Diploma in Management (Securities Markets) – PGDM (SM) (2020-22). The placement process this year was done in online and offline mode with 40 companies participating in it. The students were offered various roles such as, Treasury Dealer, Compliance Officer, Surveillance & Investigation Officer, Wealth Manager, Financial Advisor etc. The placement cell has placed all students who have opted for placement, barring 05 students.

| Salary Packages | CTC |

| Maximum | 13.67 LPA |

| Average | 7.8 LPA |

The salary package (CTC) comprises of fixed, variable and allowances offered by the company.

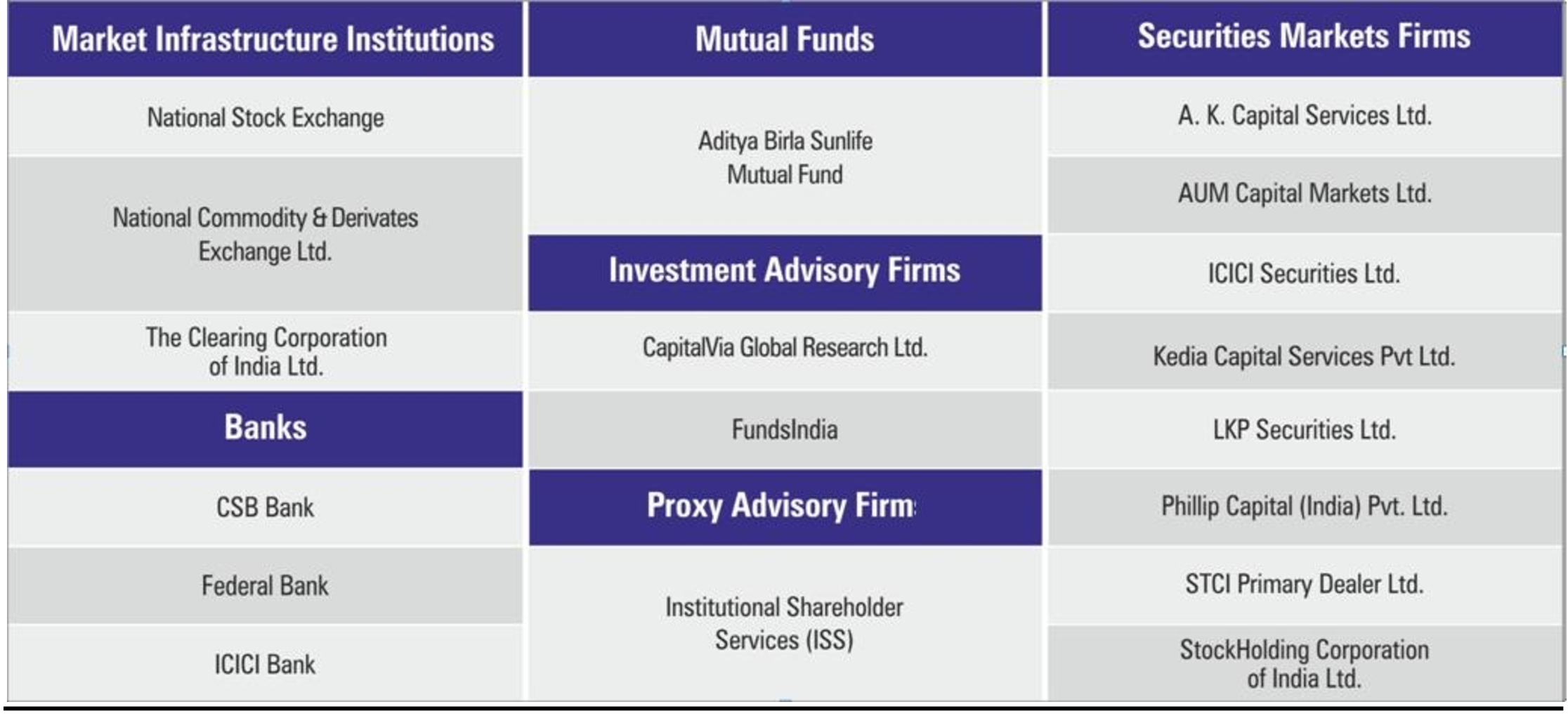

Major Recruiters:

Post Graduate Diploma in Management (Securities Markets) Placement Report 2021-2023

Executive Summary

The campus placement drive for the PGDM(SM) program at NISM was conducted at the Patalganga Campus, attracting participation from over 30 companies. Out of a batch of 78 students, 75 chose to take part in the placement process and 73 students received offers across various roles.

| Salary Packages | CTC |

| Maximum | 14.14 LPA |

| Average | 9.56 LPA |

The salary package (CTC) comprises of fixed, variable and allowances offered by the company.

Major Recruiters:

Post Graduate Diploma in Management (Securities Markets) Placement Report 2022-2024

Executive Summary

The NISM campus placement drive for the PGDM(SM) program was held at the Patalganga Campus, with participation from more than 50 companies. From the batch size of 92 students, 81 students opted in placement drive and received offers for diverse roles. The placement cell successfully secured placements for all students who opted to participate.

| Salary Packages | CTC |

| Maximum | 16.32 LPA |

| Average | 9.07 LPA |

The salary package (CTC) comprises of fixed, variable and allowances offered by the company.

Major Recruiters:

Merit Scholarships and Tuition fee waivers

It is NISMs’ endeavour to make education more affordable for students from all walks of life and ensure that every deserving student gets an opportunity for quality education. Various categories of scholarships have been made available and designed to cater to different students. Following merit based scholarships and tuition fee waiver schemes are in place:

| Sr. No | Name of the Scholarship | Description |

|---|---|---|

| 01 | Merit Scholarship | Students who have secured 1st rank at the preceding degree (in an examination where at least 120 students have taken exam in the respective University/ Institute) are eligible for 50% of the tuition fee waiver during the first year. Student shall secure at least 60% of marks along with 90% of attendance in each trimester of first year in order to continue to be eligible for 50% tuition fee waiver for the entire programme. |

| 02 | Economically Backward Students | Economically backward students, with meritorious academic record are eligible for 50% of tuition fee waiver in the first year, whose parent/guardian income is less than Rs. 4.00 lakh per annum. A student shall secure at least 60% of marks along with 90% attendance in each trimester of first year in order to continue to be eligible for such tuition fee waiver. |

| 03 | Students from local area | Students from Raigarh (MH) district securing admission in PGDM-SM program are eligible for 30% of tuition fee waiver in the first year. Student shall secure at least 60% of marks along with 90% of attendance in each trimester of first year in order to continue to be eligible for 50% tuition fee waiver for the entire program. |

| 04 | Best Performing Students | Students are eligible for 50% of tuition fee waiver for the second year for securing the first position/rank in the first year. |

| 05 | Fee waiver for Students based on admission Merit criteria | Students with 1st Class and above in graduation level along with CAT / XAT / GMAT score of 75 percentile & above and other eligible test scores of 80 percentile & above are eligible for tuition fee waiver up to 50% only in the first year of study. |

| 06 | SC/ST and backward class Students | Students from the SC/ST and Backward class category are eligible for a 50% tuition fee waiver in the first year, subject to the condition that they are selected through a competitive process in terms of prescribed eligibility criteria for selection. |

| 07 | Children of employees of SEBI Registered entities | are eligible for 30% of tuition fee waiver in first year of study. |

| 08 | Children and Spouse of SEBI and NISM Staff | Children and Spouse of Employees of SEBI/ NISM and support / outsourced staff of NISM are eligible for 40% of tuition fee waiver in the first year. They should secure at least 60% of marks along with 90% attendance in each trimester of the first year in order to continue to be eligible for such tuition fee waiver. |

General Terms and Conditions for Scholarships and Fee Waivers

- The students undergoing PGDM (SM) are only eligible for seeking tuition fee waivers/scholarships. Students undergoing joint/collaborative/ sponsored programmes are not eligible for any of the scholarships, waivers etc. as these programmes are offered based on mutual understanding between NISM and collaborating Institute/s.

- In order to become eligible for tuition fee waiver, a student shall first secure admission to the program through competitive selection process as prescribed.

- Students seeking tuition fee waiver under any of the above scheme shall pay first instalment of tuition and other fee in full at the time of admission.

- Eligible students shall make an application within one month from the date of commencement of the programme attaching relevant documents as indicated under para (e) below. Students are not allowed to make multiple applications and such applications forthwith rejected.

- Application for scholarship/ tuition fee waiver shall be submitted enclosing a) Rank Certificate issued by University/Institution for merit scholarship, b)Economically Backward Certificate issued by an Officer not below the rank of Tahasildar for Economically Backward category, c) residence certificate for local students issued by Tahasildar for local category, d) proof of score and copy of final graduation certificate for merit students, e) employees of SEBI, NISM and employees of SEBI registered entities shall make an application to the Registrar, NISM for considering tuition fee waivers and f) SC/ST and Backward class students shall submit a caste certificate issued by the Competent Authority authorised by the respective State or Central Govt. or UT Governments as per prevailing norms laid own for the purpose.

- A Student is eligible for waiver of tuition fee under only one of the schemes above. No student is eligible for scholarship/waiver under multiple schemes.

- All the Applicants and Students may note that, merely by submitting an application under any of the above scheme, will not become eligible for tuition fee waiver. All the applications received shall be scrutinised by a Committee duly constituted by the Director. The Committee shall submit its recommendations to the Director for approval. Only shortlisted candidates will be considering for award of scholarship. If more applications received under any of the scheme, the Committee has right to reduce the % of Scholarship/Waiver to accommodate more numbers students depending on the student’s merit. In all the matters relating to scholarship/tuition fee waiver, Director’s decision shall be final. There is no provision for any appeal under the scheme.

- NISM reserves right to verify correctness of the application made with the respective authorities and if is found to be incorrect at any point of time, the student shall pay the entire fee along with penalty forthwith or institute has right to take disciplinary action.

-

Dr. Rachana Baid

Professor, Dean (Academics) & HOD - Centre for Capacity Building-1

-

Dr. Jinesh Panchali

Professor - Centre for Capacity Building

-

Dr. Kirti Abhijeet Arekar

Professor - Centre for Capacity Building

-

Dr. Dhiraj Jain

Professor - Centre for Capacity Building

-

Dr. Rajesh Kumar

Professor - Centre for Capacity Building-1

-

Dr. Jatin Trivedi

Associate Professor - Centre for Capacity Building-1

-

Dr. Kapil Shrimal

Associate Professor – Centre for Capacity Building-1

-

Dr. Mohd Meraj Inamdar

Assistant Professor, CCB-2

-

Dr. Shreyas Vyas

Assistant Professor - Centre for Capacity Building-1

-

Mr. Suneel Sarswat

Adjunct Faculty

-

Mr. Madhav Mehta

Adjunct Faculty

-

Mr. Vijay Kanchan

Adjunct Faculty

-

Mr. Suresh Narayan

Adjunct Faculty

-

Mr. Amit Trivedi

Adjunct Faculty