PGDM (SM) is an AICTE approved two-year Post-Graduate Diploma Programme in Management, where the students get exposure to varied subjects and verticals of securities markets including Economics, Financial Statement Analysis, Corporate Finance, Portfolio Management, Equity Valuation, Fixed Income Securities, and Derivatives & Risk Management, Investment Banking, Mutual Funds, and Wealth Management, benchmarked with the best and contemporary texts. Post Graduate Diploma in Management (Securities Markets) – PGDM (SM)

The carefully crafted curriculum, along with application-based teaching pedagogy and industry internship, serves as a strong foundation for further grooming and growth into various career paths in the corporate/financial/securities markets. PGDM (SM) students are positioned to take up a wide range of roles and responsibilities, such as Analysts, Investment Managers, Investment Bankers, Treasury Managers, Risk Managers, Compliance Officers, Financial Planners, Wealth Managers, etc.

PGDM (SM) can lead the successful participants to the following careers pathways. Some illustrative career opportunities available for PGDM (SM) graduates are as under:

The objective for designing a programme of the status of a Post Graduate Diploma is “to create complete securities market professionals”. Since the field of securities markets represents the confluence of several related areas, the post-graduate programme in securities markets rests on the following pillars:

Each of the above-mentioned fields is fully represented in the proposed programme, with a balance between elegance and rigour. Based on SSE’s prior experience, but also after infusion of fresh thinking, the architecture of the PGDM (SM) has been conceived. Each course is benchmarked with the best-in-class textbook (recommended text) to arrive at the chosen content.

The programme has a globally benchmarked curriculum deliberated by a council of academicians and market practitioners. Divided into six trimesters, the curriculum is designed to provide research-based inputs and industry insights through a team of academicians and market experts.

| Subject Code | Course Title | Hours | Credits |

|---|---|---|---|

| 101 | Economics for Securities Markets | 30 | 3 |

| 102 | Financial Reporting | 30 | 3 |

| 103 | Financial Institutions & Markets | 30 | 3 |

| 104 | Mathematics for Securities Markets | 30 | 3 |

| 105 | Statistics for Securities Markets | 30 | 3 |

| 106A | Organisation Behaviour and Management | 15 | 1.5 |

| 106B | Excel Skills for Management | 15 | 1.5 |

| Course Title | Credits |

|---|---|

| Summer Internship | 6 |

| Subject Code | Course Title | Hours | Credits |

|---|---|---|---|

| 201 | Financial Statements Analysis | 30 | 3 |

| 202 | Corporate Finance | 30 | 3 |

| 203 | Business Communication | 30 | 3 |

| 204 | Corporate and Allied Laws | 30 | 3 |

| 205 | Financial Analytics | 30 | 3 |

| 206A | Smart Lab I | 15 | 1.5 |

| 206B | Mutual Funds | 15 | 1.5 |

| Subject Code | Course Title | Hours | Credits |

|---|---|---|---|

| 301 | Securities Analysis and Equity Valuation | 30 | 3 |

| 302 | Securities Market Laws and Regulations | 30 | 3 |

| 303 | Fixed Income Securities | 30 | 3 |

| 304 | Fintech in Financial Markets | 30 | 3 |

| 305 | Derivatives & Risk Management-I | 30 | 3 |

| 306A | Marketing of Financial Products & Services | 15 | 1.5 |

| 306B | Research Methods and Data Analytics | 15 | 1.5 |

| Subject Code | Course Title | Hours | Credits |

|---|---|---|---|

| 401 | Fixed Income Securities | 30 | 3 |

| 402 | Derivatives & Risk Management II | 30 | 3 |

| 403 | Portfolio Management | 30 | 3 |

| 404 | Treasury Management | 30 | 3 |

| 405 | Market Infrastructure Institutions | 30 | 3 |

| Subject Code | Course Title | Hours | Credits |

|---|---|---|---|

| 501 | Corporate Restructuring and Valuation | 30 | 3 |

| 502 | Commodities Markets | 30 | 3 |

| 503 | Financial Planning & Wealth Management | 30 | 3 |

| 504 | Financial Modelling & Research Report Writing | 30 | 3 |

| 505A | Smart Lab – II | 15 | 1.5 |

| 505B | Investment Banking | 15 | 1.5 |

| Subject Code | Course Title | Hours | Credits |

|---|---|---|---|

| 601A | ESG Factors and responsible investing | 15 | 1.5 |

| 601B | Forex Markets and International Finance | 15 | 1.5 |

| 602A | Alternate Investment Funds | 15 | 1.5 |

| 602B | Taxation for Securities Markets | 15 | 1.5 |

| 603 | Project Dissertation (Off Classroom) | – | 6 |

| 604 | Professional Certifications (Off Classroom) | – | 6 |

Total Credits: 108

| Sr. No. | Certification Name |

|---|---|

| 1 | NISM Series V A: Mutual Fund Distributors Certification Examination |

| 2 | NISM Series VII: Securities Operations and Risk Management Certification Examination |

| 3 | NISM-Series-X-A: Investment Adviser (Level 1) Certification Examination |

| 4 | NISM-Series-VIII: Equity Derivatives Certification Examination |

| 5 | NISM Series-IX: Merchant Banking Certification Examination |

| 6 | NISM Series-XV: Research Analyst Certification Examination |

| Educational Qualifications | Valid Common Entrance Test Score |

|---|---|

| 1. Applicant must possess a strong and consistent academic background. Performance in 10th grade, 12th grade and every year of graduation are considered in the selection process. |

|

| 2. Passed Bachelor’s Degree of minimum 3

years’ duration and obtained at least 50% marks (45% in case of candidates belonging to reserved category) in any stream. |

The candidates are required to qualify in

anyone of the six all India Common Admission Tests i.e. CAT, XAT, CMAT, ATMA, MAT, GMAT or MH-CET (Management) in Maharashtra. |

| 3. Applicants in the last year of their

bachelor’s degree program and awaiting their final results can also apply. However, their admission will be considered as provisional and is subject to fulfilling the above mentioned eligibility criteria within the specified timeframe. |

Note: Candidates whose competitive exam results are not officially announced can also submit the application form. However, candidate has to submit the competitive exam score to NISM Admission office once the results are announced, until then the admission will be stated as provisional.

Selection shall be based on the educational qualifications of the candidate, competitive exam score and Personal Interview (PI). Provisional admission offered to selected candidates, who do not pay the fees on or before the stipulated date would automatically stand cancelled.

Candidates are required to register themselves online on https://apply.nism.ac.in/pgdm/

Step 1: New Registration: Upon successful registration, a User-ID and Password will be sent to registered email ID and mobile number of the candidate.

Step 2: Fill the Application form and upload all relevant documents.

Step 3: Pay the application fee of ` 1000/- (One thousand only) and other applicable charges.

| Particulars | 1st Installment | 2nd Installment | 3nd Installment | 4nd Installment |

|---|---|---|---|---|

| Tuition fee | 1,38,000 | 1,38,000 | 1,38,000 | 1,38,000 |

| Library fee | 10,000 | 10,000 | 10,000 | 10,000 |

| Exam fee | 5000 | 5000 | 5000 | 5000 |

| Alumni fund | 2000 | – | – | – |

| Total Program fees (A) * | 1,55,000 | 1,45,000 | 1,45,000 | 1,45,000 |

| Library Deposit – Refundable (B) | 10,000 | – | – | – |

| Total fees including Refundable deposits (A + B) | 1,65,000 | 1,45,000 | 1,45,000 | 1,45,000 |

| Gross Total | 6,00,000 | |||

| Gross Total | 6,00,000 | |||

| Due Date | Within seven days of receiving offer letter | November 01, 2025 | June 15, 2026 | November 01, 2026 |

If a student chooses to withdraw from the program of study in which he/she is enrolled, the institute will follow the

following three-tier system for the refund of fees remitted by the student.

| Sr. No | Refund Amount | Point of time when notice of withdrawal of admission is served to the Institute |

|---|---|---|

| 01 | The fee paid will be refunded after a flat deduction of Rs. 1,000/- | Before commencement of the programme or July 15, 2025 whichever is earlier After July 15, 2025 and the vacant |

| 02 | The fee paid will be refunded after a flat deduction of Rs. 10,000/- | seat is filled by another student from wait list. |

| 03 | The student will not be eligible for any refund, except the refund of the refundable deposits included in the fees | After commencement of the programme or after July 15, 2025, and the seat remained vacant. |

# For each teaching hour, students are required to put in minimum 2 additional learning hrs

| Particulars | First Instalment | Second Instalment | Third Instalment | Fourth Instalment |

|---|---|---|---|---|

| Hostel Charges # | 42,000 | 42,000 | 42,000 | 42,000 |

| Food Charges | 31,500 | 31,500 | 31,500 | 31,500 |

| GST on Food (5%) | 1,575 | 1,575 | 1,575 | 1,575 |

| Total Hostel & Mess Fee (A) | ||||

| Hostel Deposit – Refundable (B) | 10,000 | – | – | – |

| Total fees including Refundable deposits (A + B) | 85,075 | 75,075 | 75,075 | 75,075 |

| Due Date | Within seven days of receiving offer letter | 01- Nov- 25 | 15-Jun-26 | 01- Nov- 26 |

# Twin Occupancy non AC accommodation. However, AC will be provided in the month of March, April and May.

The hostel charges mentioned above are towards Twin Occupancy and Non-AC accommodation

| Start Date of Application | April 26, 2025 |

|---|---|

| Last date of application | June 15, 2025 |

| Commencement of Admission Interviews | Will be intimated separately |

| Declaration of Merit List | June 30, 2025 |

| Commencement of Program | July 15, 2025 |

* The Management reserves the right to change, amend programme structure and fees as when it deems fit.

Post Graduate Diploma in Management (Securities Markets), a 2-year AICTE-approved full-time program by NISM focusing on the securities markets.

Competitive Exams: CAT, XAT, CMAT, ATMA, MAT, GMAT or MH-CET (2025). MAT & ATMA scores after Jan 2025 are valid.

Yes! Admission will be provisional till graduation marks are submitted.

Ideal for students of Economics, Commerce, Finance, Engineering, or Management aiming for a capital markets career.

There are 120 seats in the PGDM (SM) program.

No! The program is not offered in distance or online mode.

Register online at https://apply.nism.ac.in/pgdm

₹1000/- + applicable charges via Debit/Credit Card, Net banking, or UPI.

Yes, Monday to Friday, 9:30 AM – 5:30 PM. Email llm@nism.ac.in to schedule.

The program includes embedded NISM certifications:

NISM is enlisted on VidyaLakshmi Portal for education loan applications.

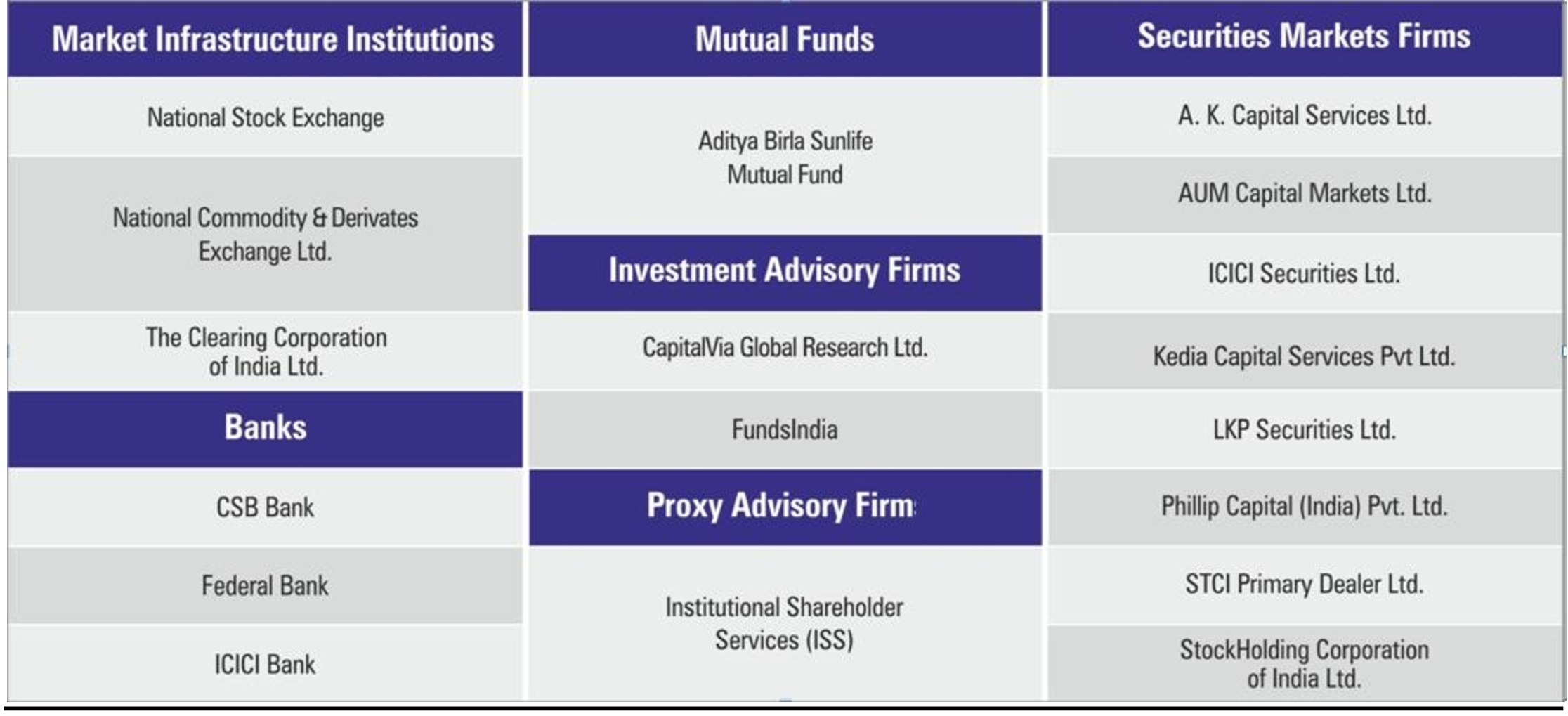

Placement profiles include: Treasury, Advisory, Merchant Banking, Compliance, Corporate Banking, etc. Recruiters include Banks, Stock Exchanges, Depositories, Mutual Funds, etc.

ICICI Bank, SBI MF, STCI, BSE Ltd., Federal Bank, Axis Trustees, IFA Global, IDBI Bank, NSDL, and more.

For any further enquiries, please connect to the admission helpdesk NISM: 08268002412

Executive Summary

The NISM Campus placement drive started from December 1, 2021 for Post Graduate Diploma in Management (Securities Markets) – PGDM (SM) (2020-22). The placement process this year was done in online and offline mode with 40 companies participating in it. The students were offered various roles such as, Treasury Dealer, Compliance Officer, Surveillance & Investigation Officer, Wealth Manager, Financial Advisor etc. The placement cell has placed all students who have opted for placement, barring 05 students.

| Salary Packages | CTC |

| Maximum | 13.67 LPA |

| Average | 7.8 LPA |

The salary package (CTC) comprises of fixed, variable and allowances offered by the company.

Major Recruiters:

Executive Summary

The campus placement drive for the PGDM(SM) program at NISM was conducted at the Patalganga Campus, attracting participation from over 30 companies. Out of a batch of 78 students, 75 chose to take part in the placement process and 73 students received offers across various roles.

| Salary Packages | CTC |

| Maximum | 14.14 LPA |

| Average | 9.56 LPA |

The salary package (CTC) comprises of fixed, variable and allowances offered by the company.

Major Recruiters:

Executive Summary

The NISM campus placement drive for the PGDM(SM) program was held at the Patalganga Campus, with participation from more than 50 companies. From the batch size of 92 students, 81 students opted in placement drive and received offers for diverse roles. The placement cell successfully secured placements for all students who opted to participate.

| Salary Packages | CTC |

| Maximum | 16.32 LPA |

| Average | 9.07 LPA |

The salary package (CTC) comprises of fixed, variable and allowances offered by the company.

Major Recruiters:

Faculty Members

Faculty Members

Faculty Members

Faculty Members

Administrative/IT Division Heads

Registrar

© 2025 National Institute of Securities Markets (NISM). All rights reserved.