Context

You must have seen the awareness campaign of Mutual Funds Sahi Hai and SIPs Sahi Hai. It is not just a campaign, but there is a rationale behind it. It is beneficial for you. The logic is, you are inculcating discipline. The money that otherwise may have been spent, is being invested for your future benefit. The other advantage is cost averaging. When markets are down and prices are low, we psychologically tend to move away. However, arguably, we should invest more when prices are down. When we continue our purchases in a disciplined manner, say every month, we are buying cheap, which leads to overall average cost of acquisition being relatively lower. This is called dollar cost averaging or rupee cost averaging.

Current situation

Markets have corrected. Nifty50 index, from its peak in September 2024 till 13 March 2025, has lost 14.6 percent. Nifty 500 index has lost 17.6 percent over the period. Nifty Midcap 150 has lost more, 20.4 percent. Nifty Smallcap 250 has lost the lost the most from September 2024 peak, 24.3 percent. However, SIP cancellations are moving up as well. In 2020, 1.25 crore SIP accounts were opened. By next year, 35 percent of those were closed. In 2021, 2.43 crore SIP accounts were opened, but by next year, 41 percent of those were closed. That is, number of accounts opened went up, but closure rate went up as well. In 2022, number of accounts opened were 2.57 crore and closures by next year were 42 percent. Year after, in 2023, number of accounts opened went up to 3.48 crore and closure rate by next year was up at 48 percent. To put it simply, half the SIP accounts opened in 2023 were closed by 2024.

This typically is a sign of lack of maturity from investors who have not seen market cycles over a long period of time. It is the nature of equity market to move in cycles, but over a long period of time, it delivers decent returns. One of the reasons for SIP closure could be consolidation – instead of multiple SIP accounts, the investor may want to operate fewer accounts. That apart, it shows a short investment horizon; much shorter than what is optimally required for investment in the equity market.

Cost averaging

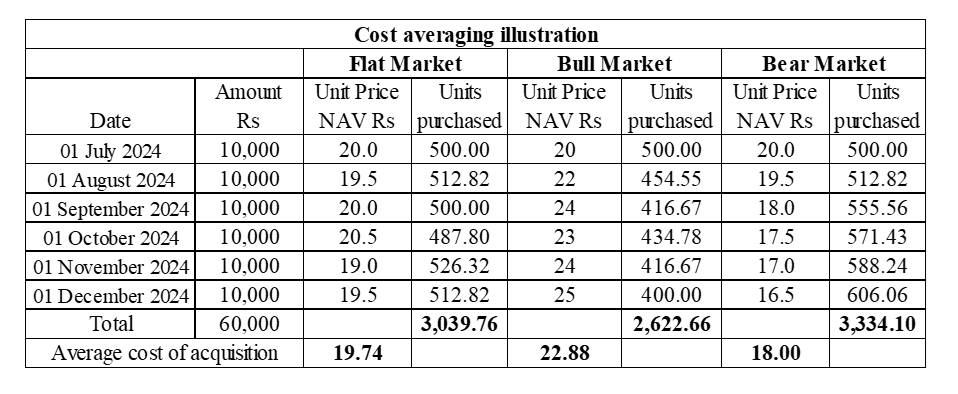

Let us look at the illustration of rupee cost averaging in three different market situations, with hypothetical data.

You have a SIP of Rs 10,000 per month, from July 2024 to December 2024. The market level varies; accordingly, the NAV of your fund varies as well. The number of units purchased is a function of the unit price or NAV: it is the amount i.e. Rs 10,000 divided by Rs 20 in July 2024. In July 2024, you acquire 500 units of your fund, at a price of Rs 20.

In a flat market condition, the NAV fluctuates, but only so much. You acquire units every month at the given unit price. At the end of six months, you acquire 3,039.76 units, which is the total of the units acquired over six months. Since you have invested Rs 60,000 and at the end of six months you have 3039.76 units, the average cost of acquisition is Rs 19.74. The crux of the matter is, this is lower than if you would have invested lump sum Rs 60,000 in July 2024, when the price was Rs 20.

In a bull market, the NAVs are higher since stock prices are moving up. Your average cost of acquisition is Rs 60,000 divided by 2,622.66 units i.e. Rs 22.88. Though the cost of acquisition is higher, investors do not mind. In a bull market, there is a feel-good factor around and investors are in a positive frame of mind. In the bear market illustration, the NAV is coming down and you acquire a greater number of units. Your average cost of acquisition is Rs 60,000 divided by 3,334.1 units i.e. Rs 18. To be noted, in a bear market, you acquire more units, but your value at the end is relatively lower. In December 2024, your value is 3334.1 units multiplied by Rs 16.5 = Rs 55,013. In a bull market, you acquire lesser number of units but your value at the end is relatively higher. In the bull phase illustration, your terminal value is 2,622.66 units multiplied by Rs 25 = Rs 65,567.

Conclusion

The purpose of SIP is disciplined investments, not trying to time the market. If you discontinue the SIP, you are defeating the very purpose of doing it. In the illustration above, the higher number of units you acquire in the bear phase, will contribute to higher portfolio value in the next bull phase. Given that there is no structural issue about the growth of the Indian economy, market is correcting due to certain cyclical issues – you can take the right decision.

Author:

“The article was earlier published in The Hindu on 31 March 2025.”

Volatility risk is well known, but that is usually less dangerous Retirees fear market volatility, and volatility is a risk…

For NISM, 2025 was defined by a renewed commitment to capacity building and investor education. Anchored by our mandate from…

The threats of money laundering (ML) and terrorist financing (TF) have grown exponentially due to the increasingly interconnected nature of…

© 2026 National Institute of Securities Markets (NISM). All rights reserved.