Mahila Samman Saving Certificate Scheme

Author: Kiranjit Kaur Kalsi

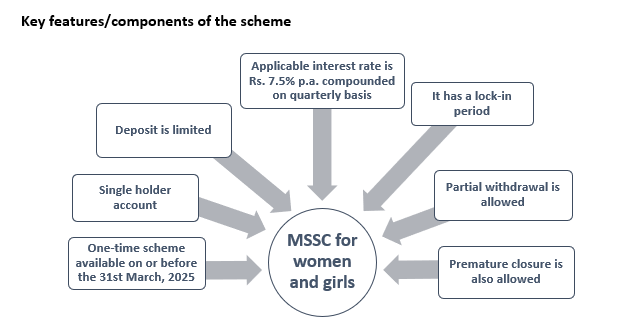

Under the Government Savings Promotion Act, 1873, the Government of India (GOI) has introduced the Mahila Samman Savings Certificate (MSSC), 2023 in Union Budget 2023-24. The MSSC scheme is in force since April 01, 2023 through the Department of Post. However, the Department of Economic Affairs, Ministry of Finance, GOI, through an e-gazette notification issued on June 27, 2023, permitted all Public Sector Banks and eligible Private Sector Banks to implement and operationalise the MSSC, 2023. These banks are known as Authorised Banks.

The principal aim of this scheme is to increase the participation of women in investments and provide them with financial security.

1. Deposit amount under this scheme is limited. The minimum limit of Rs. 1000 in multiples of rupees one hundred and Maximum of Rs. 2 Lakhs is permitted for investment in the scheme.

2. The Maturity period/Lock-in period of the scheme is 2 years from the date of opening of the account. However, the account holder can withdraw up to 40% of the account balance after one year from the account opening date as partial withdrawal.

3. MSSC is a government-supported scheme which offers a guaranteed rate of return i.e. 7.5% p.a. compounded on quarterly basis and credited to the account, hence it is safe from the market risk/credit risk.

4. There is a provision of multiple account opening under this scheme with a condition that a woman can open a second MSSC account after a minimum gap of three months from the opening of the existing account.

5. Premature closure of an account may be permitted, any time after the completion of 6 months from the date of opening of an Account on an application in Form-4 for any reason other than the following:

• on the death of the account holder

• in cases of extreme compassionate grounds such as:

i) medical support in life-threatening diseases of the account holder or;

ii) death of the guardian, that the operation or continuation of the account is causing undue hardship to the account holder

In such circumstances, the interest on principal amount will be payable at the rate applicable to the Scheme. On the other side, in the former case i.e. on premature closure after completion of 6 month, the interest rate will be reduced by 2% and payable will be 5.5%.

6. How to avail this scheme: The account opening application shall be made by a woman for herself, or by the guardian on behalf of a minor girl through any of the following entities:

i) India Post: Apply by filing the Form-I at any Post office.

ii) Authorized Banks: Currently following banks are offering the MSSC Scheme:

• Bank of Baroda

• Canara Bank

• Bank of India

• Punjab National Bank

• Union Bank of India

• Central Bank of India

7. List of documents required for opening MSSC account:

• Mahila Samman Savings Certificate Account Opening Form

• KYC documents (Aadhaar and PAN card)

• KYC form for the new account holder

• Following are valid documents for the purpose of identification and address proof

i) Passport

ii) Driving License

iii) Voter’s ID Card

iv) Job card issued by NREGA signed by the State Government officer

v) Letter issued by the National Population Register containing details of name and address

8. Agency Charges: The following agency charges will be payable to Department of Posts and Authorized Banks for operation of this scheme:

| Sl. No. | Type of transaction | Charges payable (in rupees) |

| 1 | Receipt Physical Mode | 40 |

| 2 | Receipt e-mode | 9 |

| 3 | Payments | 6.5 paise per Rs. 100 turnover |

As on October 2023, 18,08,710 accounts amounting to Rs. 11546 Crores have been opened across the country (PIB). For more details of the MSSC scheme, click here.