Beware of investment scams

What are the various investment scams?

Broadly, these are schemes conceived by people with mala fide intentions to lure and eventually cheat gullible investors.

Examples of investment scam

Among the most common examples of an investment scam are Ponzi schemes or get-rich-quick schemes.

A Ponzi scheme is a fraudulent investment scheme promising high rates of return to investors. In fact, the rate of return promised is often unreasonably or impossibly high. The scheme generates returns for earlier investors from their own money or money received from subsequent investors, rather than any actual profit earned through an economic activity.

These are also referred to as get-rich-quick schemes, like phishing scams, pump-and-dump schemes, bogus messenger groups, and bogus websites, among others.

The red flags

There are a few red flags to identify an investment scam:

High returns at no risk

All investments carry some risk. The greater the expected return, the higher the risk. In a similar manner, when someone promises overly consistent returns for very long periods, the risk is high, too.

Such high returns should be the first red flag.

Silence on associated risk

When the expected return is high and the seller is silent on the associated risks, it is a clear case of hiding the risks. It is important for an investor to understand the risks associated with a particular investment to be able to make an informed decision.

No transparency about the economic activity behind the investment product

There is an economic activity behind every investment opportunity, without which the early investors may simply be getting money only if there are new investors or subscribers to the scheme. An equity share represents part-ownership in a business that is functioning, or a debenture is the money borrowed by a company for business activities.

Unregulated entity and the investment product

In many cases, such schemes are only possible if they fall outside the regulatory regime and the players are unregistered and unregulated by any regulator.

Since the firm and the product are unregistered, the sellers are not licenced or registered either. In such cases, the probability of something going wrong is high. On top of it, when something does go wrong, there is no or very difficult recourse to recover the money lost fraudulently.

In the absence of regulations, the seller of the product sets rules that could be against the interests of the investors. One such rule could be to restrict liquidity or access to funds. While the paper profits may look high, the investor can do nothing if the gains and the capital get wiped out when things go wrong. During such times, there is no exit option for the investor.

Pressure tactics

In most such instances, the sellers employ pressure tactics like only a few days left. The pressure is built so that the investor takes a hasty decision and not enough time is available for any research.

Understand these red flags. The golden rule is: If you do not understand or are not sure, do not invest in a hurry.

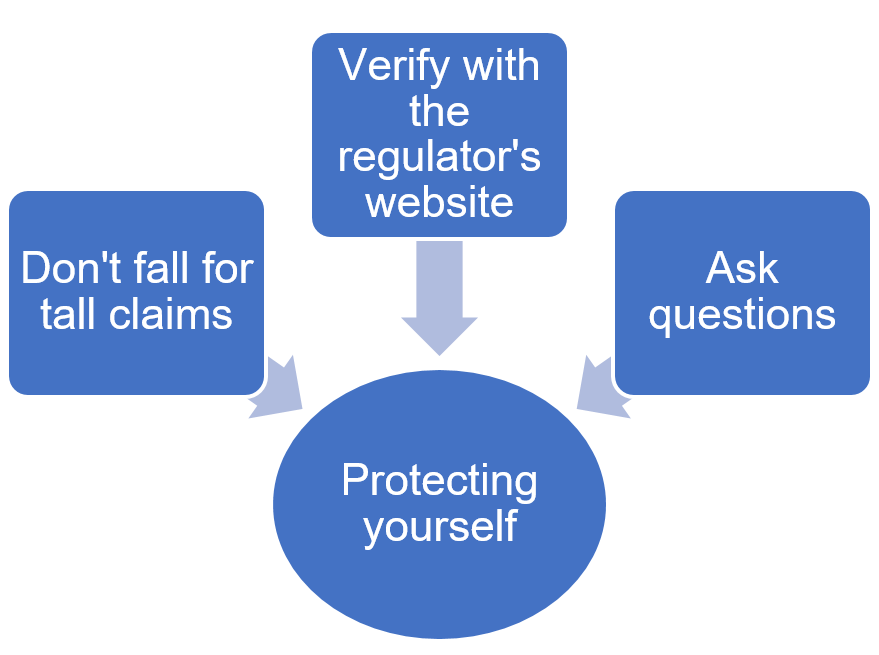

Protect your investments from such scams.

Don’t fall for tall claims.

A wise person has said, “If it is too good to be true, it often is”. Remember, if the investment returns are unreasonably high, the investment carries risk. If someone guarantees safety, the returns cannot be high. Stay away from such promises of high returns with no risk, as such schemes do not exist.

Confirm from the regulator’s website

Deal only with market intermediaries registered with SEBI while investing your money in the securities markets. In fact, for any financial product, always deal only with regulated entities. The regulator’s website carries details of the registered entities.

Ask questions

Ask relevant questions to understand the product features and the associated risks before investing money. It pays to take time to understand the product features, especially the associated risks.

You can safeguard your money by keeping these points in mind.