Understanding mutual funds

In the article “Why should one invest”, we saw the need for investing one’s surplus money. The investments can be managed by oneself or with professional help. A mutual fund is one such investment vehicle where any investor can avail themselves of the expert services of professional money managers.

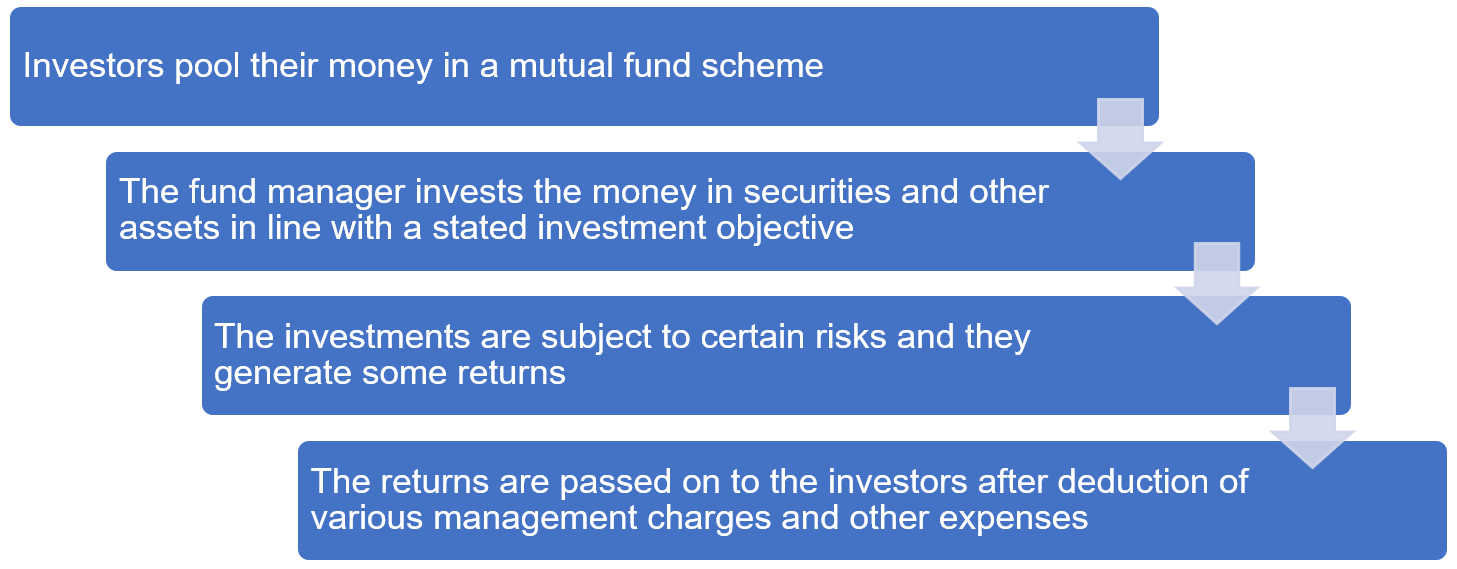

A mutual fund is an investment portfolio managed by a professional organization known as an asset management company (AMC). This AMC launches schemes (also known as products) by stating certain objectives clearly. An investor can invest in these schemes if the objective of the scheme is in line with the investor’s needs. By investing in a mutual fund scheme, the investor has outsourced the job of managing his money to the asset management company.

Advantages of mutual funds:

1. Professional management of funds:

As mentioned earlier, mutual fund schemes are managed by professional fund managers. There are registered and regulated professionals taking care of the other related tasks, too.

2. Low cost:

The asset management company charges expenses towards the management of the funds as well as paying other professionals that provide other services like fund accounting, custody of securities, auditing, and distribution of the schemes, among others. These expenses are capped by SEBI regulations.

3. Diversified portfolio:

The schemes must hold a diversified portfolio as mandated through SEBI regulations, except in certain cases.

4. Liquidity:

The open-ended funds and exchange-traded funds offer daily liquidity to the unit holders through various means. The units of closed-ended funds must be listed on stock exchanges to provide liquidity to the existing unit holders. If an investor wishes, one can redeem only part of the investment from a mutual fund scheme. One need not sell the entire investment. Such divisibility helps an investor pull out only the amount of money that he needs at a particular point in time.

5. Transparency:

Mutual funds must publish the scheme’s investment objective upfront. The portfolio in which money is invested is disclosed at regular intervals, as prescribed by the regulations. The accounting value of each unit, known as the NAV (net asset value), must be published daily. All material changes in the scheme are to be communicated to the unit holders in a timely manner. Such transparency allows unit holders (both existing and prospective) to make informed decisions.

6. Convenience:

A mutual fund investment is as easy to operate as a bank account, as on any working day, an investor can make additional investments in the same folio as well as redeem money as may be required. There are facilities to invest or redeem in a systematic manner: the systematic investment plan (SIP) and the systematic withdrawal plan (SWP).

7. Strong regulatory framework:

Mutual funds are regulated by SEBI through a strong regulatory framework.