Save for Emergencies

What are Financial Emergecies?

These are situations when one needs money urgently for some unplanned, mostly unpleasant event. The reasons could be a loss of job due to disease, disability, or loss of employment. This could also be on account of a loss of income due to the closure of a business in the case of entrepreneurs and the self-employed.

The Implication of Emergencies

The implication of this is that while income stops, expenses do not, and in some cases, expenses move up. In such situations, one needs easy and immediate access to money to fund expenses to be incurred in the short term, including regular household expenses.

The absence of an emergency fund could increase the financial hardship in such situations.

How to create an emergency fund?

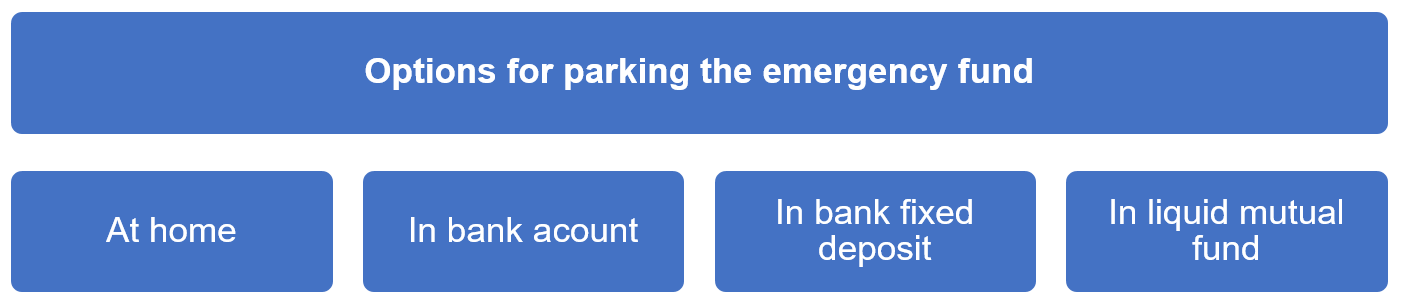

The purpose of an emergency fund is to access money when the need arises. As mentioned earlier, it is generally unplanned and unpleasant. In such a case, the primary objectives of this fund should be safety and liquidity. Earning high returns is not the objective here.

Keeping money at home or in the bank are some of the appropriate solutions. Similarly, one may also use liquid mutual funds for the said purpose.

How much emergency fund should one have?

Most financial advisors suggest that one should have an emergency fund equivalent to three to six months of household expenses. However, post-COVID-19, some have revised this number upwards to six to twelve months of expenses. If there are any other lump-sum expenses in the coming months, the same must be provided for in the emergency fund.