Understanding InvITs

•What are InvITs?

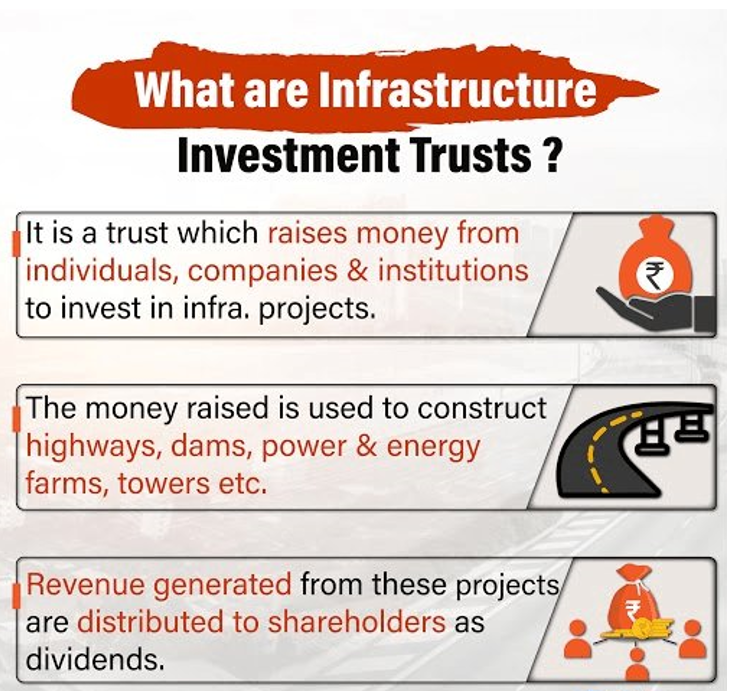

•InvITs are a type of investment vehicle that allows investors to invest in infrastructure projects. The main objective of InvITs is to provide retail investors with access to investment opportunities in infrastructure projects that were previously only available to large institutional investors.

InvITs offer investors the opportunity to invest in a diversified portfolio of infrastructure projects, which can provide stable income streams and potential capital appreciation over the long term. At the same time, it helps infrastructure projects tap into household savings

Features and structure of InvITs

Where do they invest?

InvITs are similar to mutual funds or REITs, but they invest in infrastructure assets like toll roads, power transmission lines, and pipelines.

Structure

InvITs are created by sponsors, who are typically infrastructure companies or private equity firms. The sponsor sets up the InvIT and transfers ownership of the underlying infrastructure assets to the trust. The trust then issues units to investors, which represent an ownership stake in the trust and thus the underlying assets.

Investors in InvITs can earn returns in two ways: through regular distributions and potential capital appreciation. InvITs typically distribute most of their earnings to investors in the form of dividends, which can provide a regular income stream. In addition, if the underlying assets appreciate in value over time, investors can potentially sell their units for a profit.

Advantages of InvITs

The Infrastructure Investment Trusts provide access to retail investors to invest in large infrastructure projects while offering some additional benefits.

Low ticket size: The investor can invest small amounts of money into the InvITs.

Liquidity: As the units of InvITs are listed on stock exchanges, there is reasonable liquidity (an exit option) for both the existing investors and the new investors.

Transparency: The investor can easily know where the money is invested as well as what the fair value of the investment would be as the NAV is declared regularly.

Regulations: InvITs are regulated by the Securities and Exchange Board of India (SEBI), which sets rules and regulations governing the formation and operation of InvITs. SEBI requires InvITs to distribute at least 90% of their income to investors and limits the amount of leverage that the trust can use to finance the acquisition of infrastructure assets.