Understanding Gold ETFs and Silver ETFs

Gold ETFs and Silver ETFs are exchange-traded funds that offer investors the opportunity to invest in precious metals like gold and silver, respectively.

A gold ETF is a fund that invests in gold bullion and aims to track the performance of the price of gold. Similarly, a Silver ETF invests in silver bullion and tracks the performance of the price of silver. The units of these ETFs are traded on stock exchanges and can be bought and sold like any other stock.

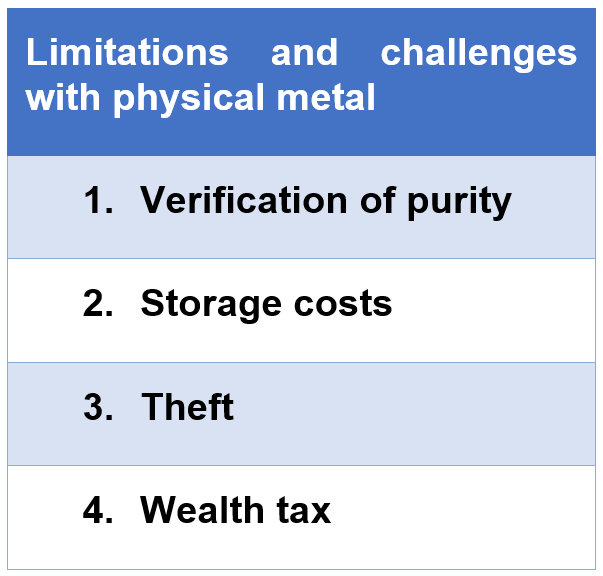

Limitations of the traditional approach

Traditionally, investors have preferred to purchase the physical metal. However, there are a few limitations to the same:

•It is difficult for small investors to verify the purity of the metal. Getting the purity certification adds a lot to the cost of acquisition, which in turn brings down the investment return.

•Storage is costly and cumbersome, especially if the quantity purchased is large.

•Theft is a serious risk if the metal is kept at home.

•Holding wealth in the form of gold or silver (like many other non-financial assets) would be subject to a wealth tax beyond a certain limit.

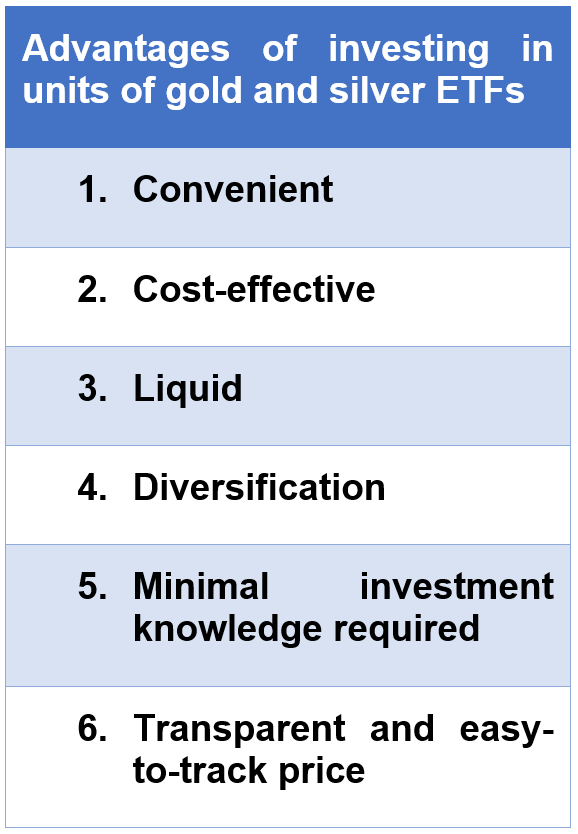

Advantages of ETFs

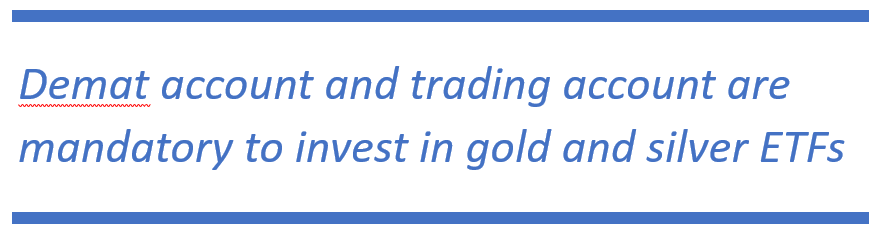

One of the key benefits of investing in Gold ETFs and Silver ETFs is that they offer a convenient and cost-effective way to invest in precious metals. The purity of the metal is assured, and it is kept in safe custody, thus eliminating the risk of theft is eliminated. Wealth tax is not applicable to financial assets. And all the unit-holder in ETFs needs to hold are the units in a demat account, in electronic form.

Moreover, investing in these ETFs offers liquidity, as the shares can be bought or sold easily through stock exchanges at any time during market hours.

Another benefit of investing in Gold ETFs and Silver ETFs is similar to that offered by the physical metal itself. They offer diversification benefits to an investor’s portfolio. Precious metals tend to have a low correlation with other asset classes like stocks and bonds, and hence, investing in Gold ETFs and Silver ETFs can help investors reduce the overall risk of their investment portfolio.

Furthermore, investing in Gold ETFs and Silver ETFs is relatively easy and requires minimal investment knowledge. Investors can start investing with small amounts and choose to invest through their trading or demat account. Additionally, since the investment is made in a publicly traded security, the pricing of these ETFs is transparent and easy to track.

In conclusion, Gold ETFs and Silver ETFs offer a convenient, cost-effective, and diversified way to invest in precious metals.

Retail investors can benefit from investing in these ETFs, as they offer exposure to the underlying asset, liquidity, and ease of investment. However, it’s important to note that investing in these ETFs involves market risk.