Understanding shares

An important need for investors is to grow their invested capital faster than inflation. This can be achieved by investing in equity shares.

Shares are issued by companies to raise capital to set up and then run the business. The securities markets help them raise the same from the general public, who can participate in the growth of the business of the company by being part-owners.

What are shares?

Shares represent part-ownership in a business. Each shareholder holds ownership commensurate with the number of shares held in a company out of the total issued shares.

Features of the shares

Each share has a specific denomination, called its “face value. Unlike bonds, shares do not have a maturity date or a maturity period. The ownership of shares is perpetual, or as long as the person does not transfer the shares to someone else.

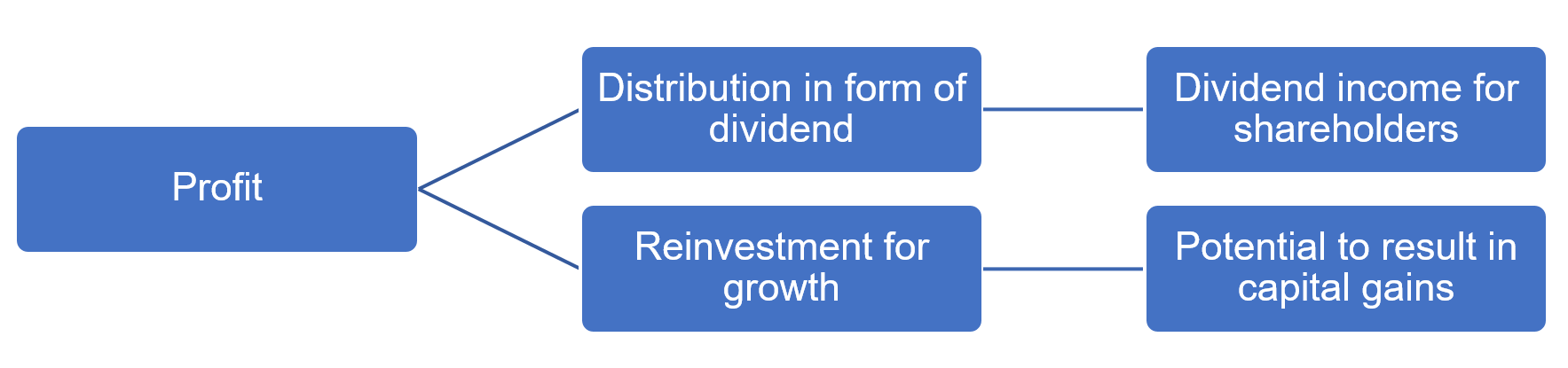

The company may share some of the profits with the shareholders in the form of a dividend. Neither the dividend quantity nor the frequency of the payouts are guaranteed. The part of profits that is not shared as dividends is reinvested in the business. This reinvestment can fuel the future growth of the company’s business.

The issuers

While the above discussion mentioned companies, banks and public sector undertakings (PSUs) also issue shares to raise capital from the capital market.

The earning for the investor

Over a long period of time, the investor can earn in form of a combination of dividends and capital gains, if the company remains profitable and grows the profits over years.

The risk of losing money

The primary risk in the case of shares is the loss of investment if the company does not survive a downturn or any adverse situation. In such a case, the investor has no recourse. The second risk is the non-receipt of dividends for long periods of time if the company decides not to distribute the profits to the shareholders. However, if the company is profitable and keeps reinvesting the profits, the share price will rise in the secondary market.

The other risk for the shareholders is that the prices of shares fluctuate a lot in the secondary market. At the same time, there could be long periods of time during which the prices remain lower than the price at which one purchased the shares.

Takeaways

1. Shares represent part-ownership in a business, and each shareholder’s ownership is commensurate with the number of shares held.

2. Investors can earn through a combination of dividends and capital gains over a long period of time, but the primary risk is the loss of investment if the company does not survive a downturn or adverse situation.

3. The prices of shares can fluctuate significantly in the secondary market, and there is no guarantee of dividend payouts or the frequency of payouts.