Understanding ETF

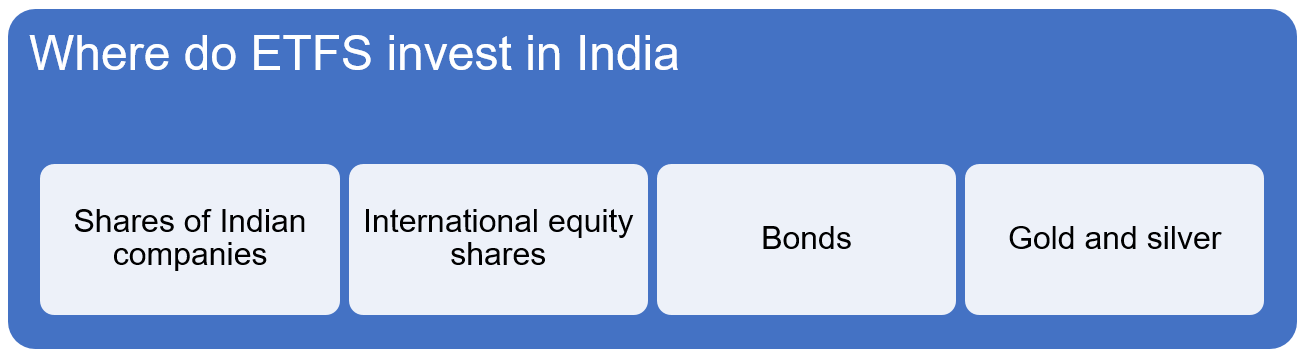

An Exchange-Traded Fund (ETF) is a simple investment solution for a retail investor. It is a type of mutual fund whose units are traded on stock exchanges like shares. Like any other type of mutual fund, the investors’ money is pooled into a corpus that is invested in various securities to meet a defined investment objective.

The construct

Most of the ETFs worldwide are passive. They replicate a market index, be it a stock index, a bond index, or a commodity index. In that sense, the ETFs do not aim to outperform the index but merely deliver index-like returns to investors before expenses.

As these funds are passive, their expense ratios are generally lower than those of actively managed mutual funds.

Advantages of ETF

ETFs offer multiple benefits over open-ended mutual funds in terms of real-time price and low costs. Many investors and investment advisors prefer ETFs in order to invest in an asset category or a market. ETFs are considered to be a highly cost-efficient solution for passive portfolios.

The price per unit on the stock exchanges also closely tracks the real-time NAV, which ensures that the investor gets almost index-like returns.

Uses of ETFs

One of the primary uses of ETFs is to take exposure to a particular market or a segment of it; e.g., one can participate in the Indian stock markets by simply buying the units of an index that tracks a broader market index like the S&P BSE 500 or Nifty 500. Similarly, one can participate in the Indian banking sector by buying units of an ETF that tracks the banking sector index..

Limitations of ETFs

Unlike units of mutual funds, ETF units are not available in fractions. There are additional costs that one must keep in mind, e.g., brokerage charges payable to the stock brokers while buying or selling the units and demat charges, as applicable.