Importance of dealing with regulated entities

The need for a regulator and regulations in securities markets

Investors need confidence in the securities markets in order to invest their hard-earned money. The presence of a regulatory framework is essential to imparting that confidence. In the absence of confidence, household savings would not flow into the economy and choke it.

Difference between regulated markets and unregulated markets

As discussed above, SEBI frames the rules, which every participant in the securities markets must follow. There are no concessions given to anyone, large or small. This may or may not happen in unregulated markets in the absence of a regulator. The consumer in the securities market exactly knows the various processes and the expected turnaround time. The penalty for noncompliance could be really heavy, ranging from a monetary penalty to being barred from securities markets for a certain period of time.

The second advantage of regulated markets is the presence of well-documented grievance redress processes, which are often missing in unregulated markets. In regulated markets, if a consumer is not satisfied with the services of the service provider, he or she can approach the regulator for redress of the grievance. In unregulated markets, such a recourse may not be available.

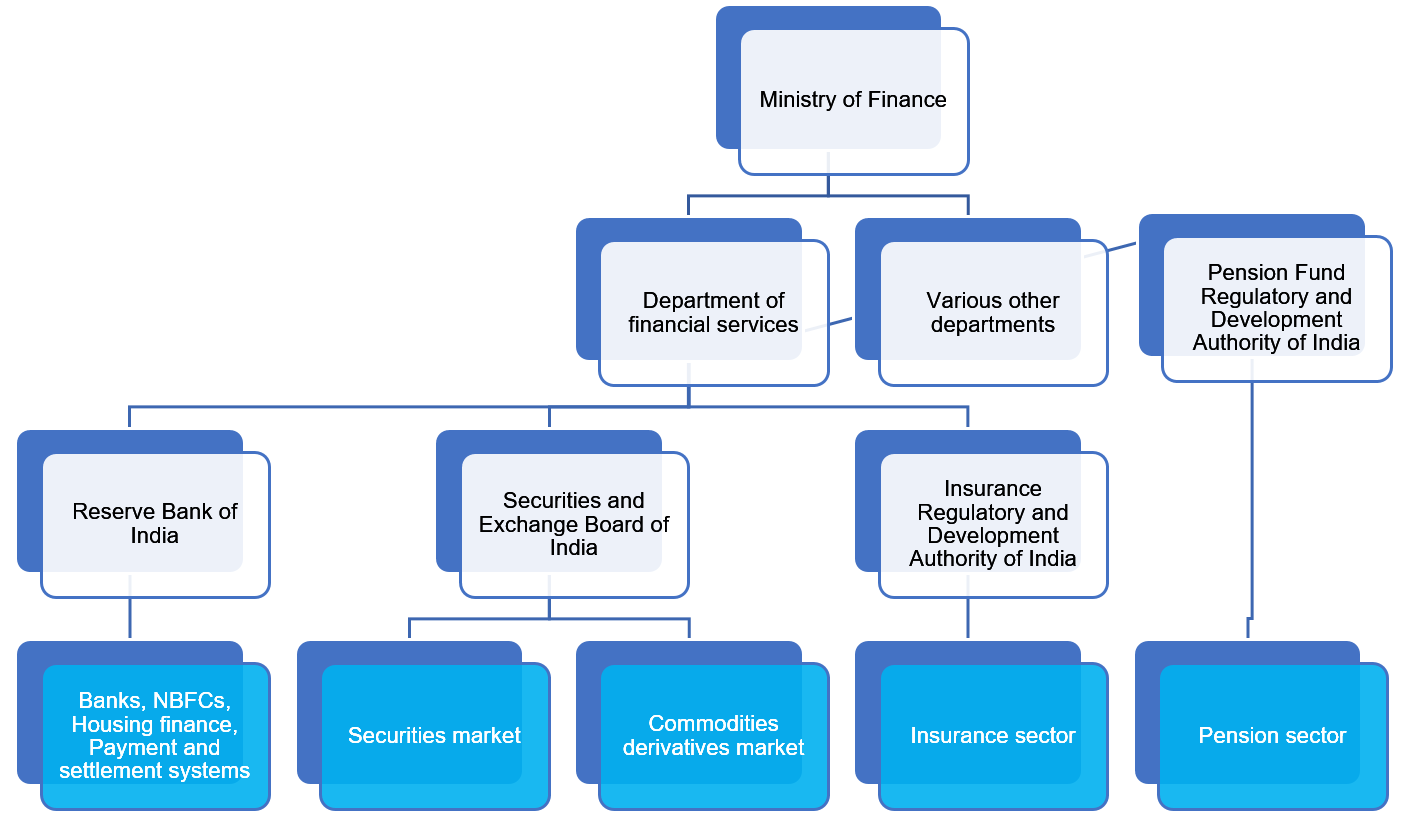

The financial landscape

The financial sector in India is well regulated, with four sector-specific regulators covering a wide array of personal finance areas. Let us take a look at the regulatory structure: