Understanding derivatives

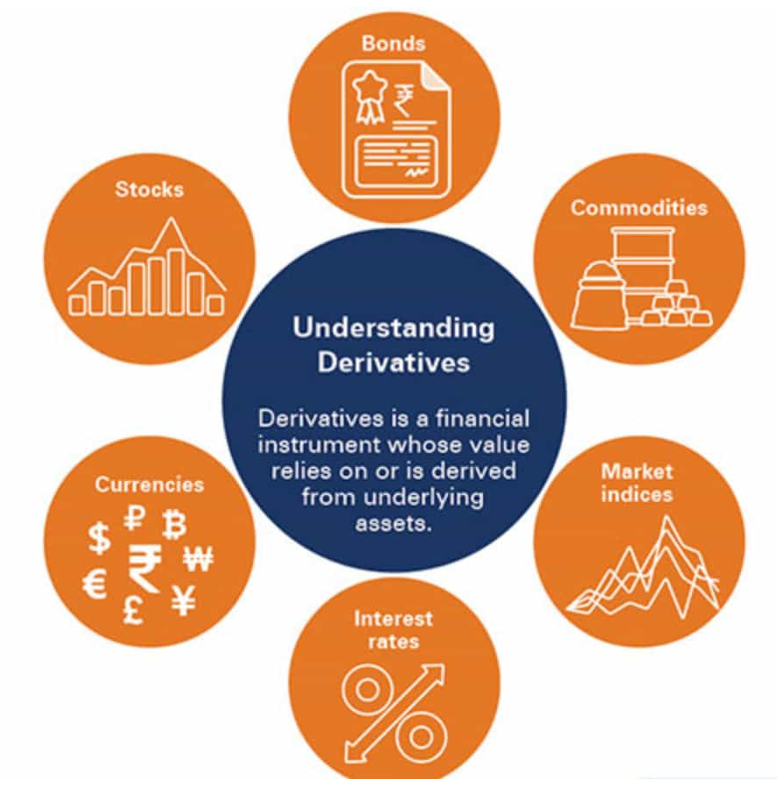

A derivative is a contract between two parties. The value of this contract is derived from the value of some assets. This other asset is referred to as the underlying. Derivatives could be based on any of the following assets:

• Various commodities

1. Agricultural commodities like wheat, coffee, pulses, sugar, cotton, etc.

2. Metals like gold, silver, copper, etc.

3. Energy resources like crude oil, coal, natural gas, etc.

•Financial assets like stocks and bonds.

However, derivatives may not just be restricted to assets, as the underlying could be interest rates, foreign exchange rates, price volatility, or even credit risk.

Each derivative contract has a date on which it expires. This date is known as the expiration date. These contracts are to be settled (in most cases) at a future date at a per-determined price. The difference between the current price and the future price is the compensation payable by one party to the other.

Uses of derivatives

Derivatives are believed to have originated for the purposes of hedging the risk of future uncertainties.

For example, when a farmer sows a crop, he is not sure how much the crop will fetch in the future or even whether it will fail for some reason.

In such a case, the farmer may enter into a contract with a merchant, in which case both parties agree to settle the contract at a particular future date at a particular price. Thus, if the farmer is able to deliver the crop, he is assured of the price. The risk of price uncertainty is hedged.

However, these days, derivatives are extensively used for two other purposes, viz., speculation and arbitrage.

Speculation: When one wants to take a view on the direction of the price of some underlying, one can simply buy a derivative rather than buying the underlying, as lower amounts are involved.

Arbitrage: There is often a difference between the prices of (i) the underlying in the regular market (called the cash market) and (ii) the price of the futures contract on the same underlying. In such a case, buying in one market and selling simultaneously in another can yield some profits, though mostly small ones.

Risk

One of the features of derivatives contracts is that the amount payable for them is reasonably small in comparison to the market price of the underlying. This could lead to profits or losses being multiplied. If the investor is speculating and gets the decision wrong, derivatives have the potential to wipe out one’s net worth.

Warren Buffett is believed to have called derivatives “financial weapons of mass destruction” due to their potential damage.

Derivatives are a zero-sum game, unlike some of the other investments like stocks, where the stock price is related to the profit growth of the company and the investors can also earn dividends, or debentures, where the investor is entitled to earning interest. In the case of derivatives, one party makes profits while the other loses. In such a case, one must be extra cautious, as the risk of being on the losing side is high, especially for the less knowledgeable.

Since derivatives are contracts, one of the major risks is that the counterparty will not honor its commitment—the counterparty risk. However, in India, in all exchange-traded derivative contracts, the presence of a clearing house or clearing corporation eliminates this risk completely.