Author: Kiranjit Kaur

The Pension Fund Regulatory Development Authority (PFRDA) through its circular PFRDA/2023/26/Sup-CRA/07 dated August 10, 2023 has introduced a simplified and secured way to keep the NPS subscribers informed about their NPS Investments. Earlier the investors were reliant only on the periodic NPS Statement of Transaction (SoT) or could view the same online in the CRA login. Now, in line with the government’s vision to create a comprehensive record of every individual’s financial assets, a facility to integrate the NPS SoT with the Consolidated Account Statement (CAS) is provided.

The CAS is issued by the SEBI registered depositories viz., National Securities Depository Limited (NSDL) and Central Depository Services Ltd (CDSL). It includes Demat Account holdings and Mutual Fund holdings of the investors.

The salient features of the integrated NPS SoT in CAS are as follows:

a. Consent Basis:

The NPS Subscribers need to give their consent for the inclusion of NPS SoT on the particular website of the Central Record Keeping Agencies (CRAs). The CRAs registered under NPS are Computer Age Management Services Ltd., KFin Technologies Limited and Protean eGov Technologies Ltd.

b. Nominal Charges:

A fee of Re 1/- will be charged for each physical statement requests, while 10 paise will be applicable for each email statement.

Benefits of incorporating NPS SoT in CAS:

a. One statement for different investments: There will be no need to maintain separate statements for different investments because the CAS summarizes the details into one comprehensive statement.

b. Easy to manage: The CAS reduces paperwork and provides a consolidated view of all investments at one place, making it easier to manage and track them.

c. Ensures Safety: With the monthly updates, the Subscribers can stay alert and prompt in identifying any unauthorized transactions. In case of fraudulent activities, the Subscribers can inform the associated intermediary at the earliest for required action.

d. Make informed decisions: The subscribers/investors can also easily monitor the performance of their investments, stay up to date with any changes, and make informed decisions accordingly.

Approximately 50000 NPS subscribers have opted for this facility so far. You may opt too with the following steps:

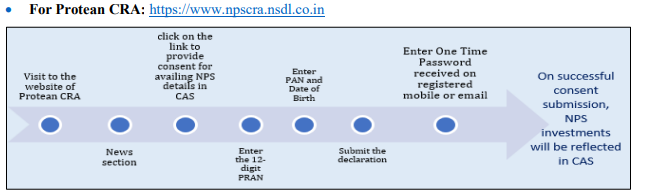

• For Protean CRA: https://www.npscra.nsdl.co.in

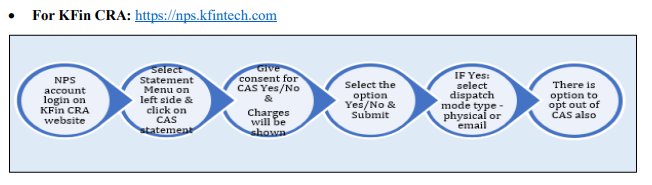

• For KFin CRA: https://nps.kfintech.com

• For CAMS CRA: https://www.camsnps.com/

1.Log in to CAMS NPS Account, and navigate to the “statements” tab.

2.In the Statement section, select the “CAS” option.

3.Provide consent for sharing NPS details with the depository and “submit”.

Volatility risk is well known, but that is usually less dangerous Retirees fear market volatility, and volatility is a risk…

For NISM, 2025 was defined by a renewed commitment to capacity building and investor education. Anchored by our mandate from…

The threats of money laundering (ML) and terrorist financing (TF) have grown exponentially due to the increasingly interconnected nature of…

© 2026 National Institute of Securities Markets (NISM). All rights reserved.