- I. Who is/are Securities and Exchange Board of India (SEBI) Registered Research Analyst?

- A SEBI Registered Research Analyst can be a person or entity registered under the SEBI Research Analysts (RA) Regulations, 2014. As per these regulations:

- 1. A Research Analyst means a person who, for consideration, is engaged in:

- a) the business of providing research services and

- b) includes a part-time research analysis.

- 2. A Research Entity means an intermediary registered with SEBI who is also engaged in:

- a) merchant banking; or

- b) investment banking; or

- c) brokerage services; or

- d) underwriting services; and

- e) issue research report or research analysis in its own name through the individuals employed by it as research analyst and includes any other intermediary engaged in issuance of research report or research analysis.

- 3. No person shall act as a research analyst or research entity or hold itself out as a research analyst unless he has obtained a Certificate of Registration from SEBI. This provision is subject to various conditions, therefore, readers are advised to refer to Chapter II Regulation 3 of the SEBI Research Analyst Certification Examination.

- II. What are the eligibility criteria to become a SEBI Registered Research Analyst?

- The eligibility criteria for the grant of Certificate of Registration to be fulfilled by an applicant is as follows:

- 1. Qualification & Other Requirements for a Research Analyst

- a) Minimum Qualification Requirements for Research Analysts

- The following individuals must meet certain qualification requirements at all times:

- Individual research analysts,

- Principal officers of non-individual research analysts,

- individuals employed and partners of a research analyst engaged in research services

They must have:

- 1. A graduate, postgraduate degree or diploma, or professional qualification in fields like:

- i. Finance, Accountancy, Business Management, Commerce, Economics, Capital Markets, Banking, Insurance, Actuarial Science, or other financial services from a university or institution recognised by Central government or any State Government or a recoganised foreign university or institution or association; or

- 2. A professional qualification by either:

- i. completing a one-year Post Graduate Program in Securities Market (Research Analysis) from NISM, or

- ii. obtaining a CFA Charter from the CFA Institute.

- b) Additionally:

- Persons associated with research services must have at least a graduate degree from a university or institution recognized by the Central Government or any State Government or a recognized foreign university or institution.

- All such individuals must hold a valid NISM certification as specified by SEBI.

- A fresh relevant NISM Certification as specified by SEBI from time to time shall be obtained before expiry of the validity of the existing certification to ensure continuity in compliance with certification requirements.

- 2. Type of Applicant

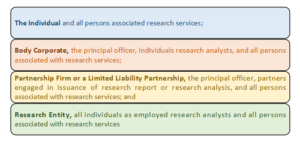

For the purpose of grant of Certificate of Registration, the applicants are required to be certified and qualified as per the Regulation 7 of the SEBI RA Regulations, 2014. They are:

- 3. Other Criteria

- Deposit Requirement: The applicant must meet the deposit requirements specified in Regulation 8 of SEBI RA Regulations, 2014.

- Fit and Proper Criteria: The applicant, must be “fit and proper” as per the criteria listed in Schedule II of the SEBI (Intermediaries) Regulations, 2008.

- Adequate Infrastructure: The applicant must have suitable infrastructure to effectively carry out research analyst activities.

- Past Refusal of Registration: If the applicant or any connected person has previously been refused registration by SEBI, the reasons for such refusal will be considered.

- Disciplinary History:Any past disciplinary action by SEBI or other regulatory authorities against the applicant or connected persons will also be examined.

- Enlistment with a Recognised Body: The applicant must be enlisted with a body or body corporate recognised by SEBI under Regulation 14 of SEBI RA Regulations, 2014.

- III Which exam should I take to become a SEBI Registered Research Analyst?

- For becoming a SEBI registered research analyst:

- i. You must pass the NISM Series-XV: Research Analyst Certification Examination(Exam is held at Test Centre).

- ii. The certificate awarded upon successful completion is valid for three years.

- iii. To continue practising as a research analyst, it is mandatory to renew the certificate before its expiry. You can do so either by passing the NISM Series-XV: Research Analyst Certification Examination again or by clearing the NISM Series XV-B: Research Analyst Certification (Renewal) Examination(Exam is remotely proctored).

- IV How can I register for the NISM Research Analyst exam?

- You can register online via https://certifications.nism.ac.in. Refer this to know the step-by-step process of registrationfor NISM Exam.

- V. What topics are covered in the NISM Research Analyst exam?

- The NISM-Series-XV: Research Analyst Certification Examinationestablishes a minimum knowledge benchmark for individuals registered as Research Analysts under SEBI RA Regulations, 2014. The certification examination workbook covers essential topics such as:

- Basics of Indian securities markets and key financial terminologies

- Fundamental research approaches (top-down and bottom-up)

- Microeconomic and macroeconomic analysis

- Company analysis (qualitative and quantitative)

- Risk, return, and valuation principles

- Corporate actions and regulatory framework

- Guidelines for writing effective research reports

The NISM Series XV-B: Research Analyst Certification (Renewal) Examination Examination includes advanced topics like:

- Accounting quality assessment and red flag identification

- Valuation catalysts and market trend analysis

- Technical analysis and value migration in equity markets

- Overview of derivatives and commodities markets

VI. How do I apply to SEBI for research analyst registration?

- After clearing the above-mentioned NISM exam, you need to:

- i. Prepare necessary documents (application form, certificates, KYC, etc.)

- ii. Submit an application on SEBI’s intermediary portal: https://siportal.sebi.gov.in/intermediary/index.html

- iii. Pay the applicable registration fee, subject to 18% GST.

- iv. Await SEBI’s verification and approval.

- v. For Self-Registration, click here.

VII. What are the key responsibilities of a SEBI registered research analyst?

- As per Regulation. 2(1) (wa) of SEBI RA Regulations, 2014, Research Analyst must perform Research Services such as:

Apart from the above, a research analyst must follow the Code of Conduct and Practices as specified by SEBI.

VIII. Is it mandatory to register with SEBI to work as a research analyst in India?

- Yes As per SEBI RA Regulations, 2014, any Person and Entity offering research services in securities markets must be registered with SEBI.

IX. Where can I get more help and updates?

- You can visit the official websites:

- i. SEBI – www.sebi.gov.in

- ii. NISM – https://www.nism.ac.in/certifications/

Author: Dr. Kiranjit Kaur Kalsi,

Sr. Assistant Manager – Centre for Content Creation