SEBI has reclassified Real Estate Investment Trusts (REITs) as ‘equity,’ while Infrastructure Investment Trusts (InvITs) remain in the hybrid category.

The markets regulator has changed how mutual funds can treat investments in real estate assets. Real Estate Investment Trusts now get the ‘equity’ tag but Infrastructure Investment Trusts remain in the hybrid category. For investors, this means more choices within mutual funds, explains V Shunmugam

How do REITs and InvITs work as investment vehicles?

SHARES OF REAL estate developers offer exposure to gains from rising property prices, but Real Estate Investment Trusts (REITs) go further—they channel rental income from offices, malls, and warehouses directly into your portfolio. This means you’re not only betting on property valuations; you’re also sharing in the steady income those properties produce.

Infrastructure Investment Trusts (InvITs) expand this concept to infrastructure by pooling money into highways, power lines, and renewable projects, allowing investors to access tolls, usage charges, and contracted revenues—cash flows that were previously available only to operators.

With the Securities and Exchange Board of India (Sebi) changing the rules, REITs are now classified as part of the equity category and may soon enter equity indices, while InvITs remain in the hybrid category but benefit from their full ‘10% NAV’ headroom. Together, they bring investors closer to the tl

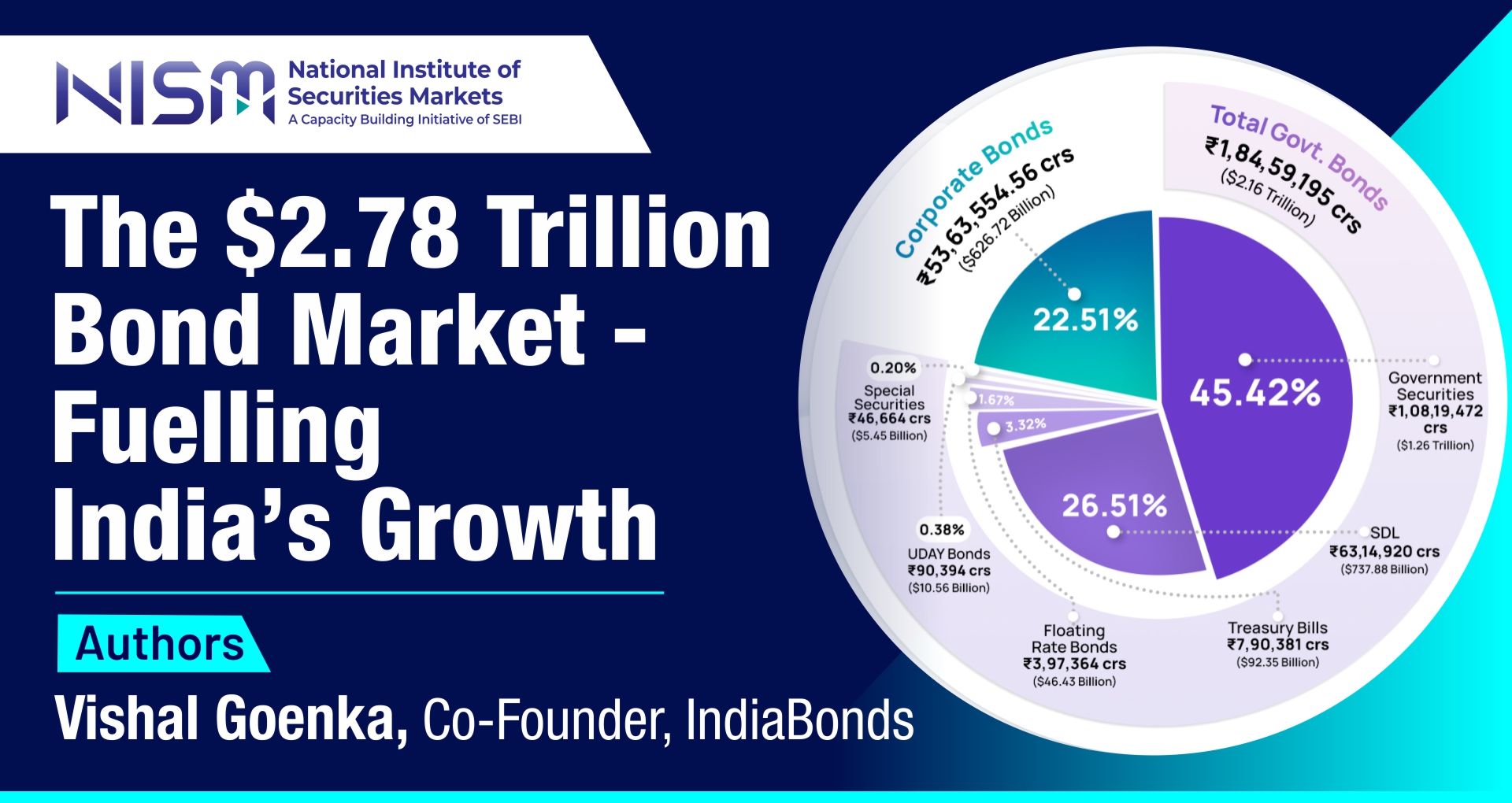

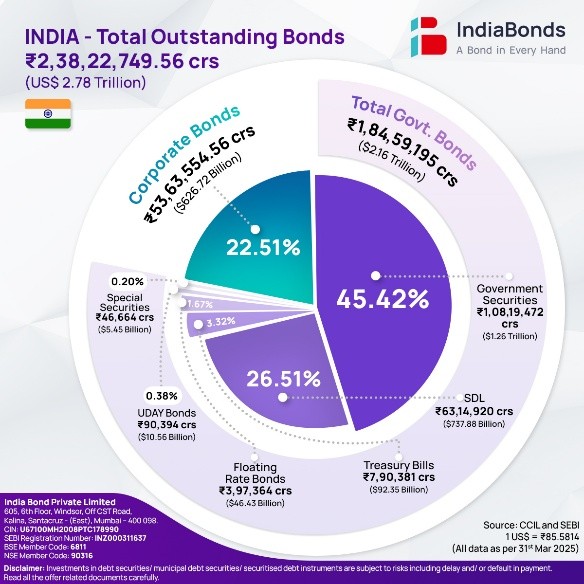

Market capitalisation of REITs and InvITs

The total market capitalisation of REITs across the four listed trusts as of mid-2025 exceeded Rs 1 lakh crore. That amounts to over Rs 2.25 lakh crore in assets under management, with steady rents, high occupancy, and regular payouts to investors. Meanwhile, InvITs have also expanded — with 17 listed InvITs, the combined market cap of REITs and InvITs is about Rs 9 lakh crore.

Started in 2019, these instruments are no longer experiments. They’re becoming substantial enough to behave like equities in many ways: they trade, they yield, they attract investor attention. And now, with Sebi’s change in classification, there’s more room for InvITs investments to grow, and for REITs to benefit from being part of equity indices and equity-oriented portfolios.rue value of India’s property and infrastructure assets.

What’s in it for the investor

FOR INVESTORS, THE benefit is straightforward: more choices within the mutual funds they already know. A regular equity scheme can now include REITs, giving investors not just exposure to property prices but also a share of the rental income from offices, malls, and warehouses — almost like owning real estate without the hassle. InvITs take this idea to infrastructure by pooling money into highways, power networks, and renewable projects, passing on part of the steady tolls and contracted revenues to investors.

Mutual funds & their investment buckets to benefit

PREVIOUSLY, REITs AND InvITs shared a common investment cap within mutual funds. If a fund manager wanted to allocate more to REITs, it would reduce the amount of funds available for InvITs, and vice versa. Now, REITs are fully placed in the equity bucket, leaving InvITs with the entire space under the hybrid category. This change simplifies portfolio design for fund managers in asset management companies. They can now use REITs to strengthen the equity portion with stable rental income while also increasing the InvIT exposure, enabling long-term infrastructure cash flows.

Impact on stock market indices

THE RECLASSIFICATION ALLOWS REITs to be included in equity indexes. Once that occurs, index funds and ETFs tracking those benchmarks will automatically invest in REITs. This will increase visibility, liquidity, and investor participation in the real estate sector. Meanwhile, InvITs continue to provide stable income options within hybrid and solution-focused funds. Together, these changes strengthen the connection between household savings and India’s real asset sectors, benefiting both investors and the broader economy.

With REITs moving into the equity bucket, InvITs now get the full 10% NAV headroom under hybrids, giving them more space to grow. This shift directs larger pools of capital into both real estate and infrastructure, strengthening two pillars of India’s growth story. As institutional investors step in, trading volumes are likely to rise, making price discovery in these markets more transparent and efficient.

Entry of new strategic investors

SEBI HAS ALSO expanded the strategic investor category under the REIT and InvIT framework to include pension funds, insurance companies, provident funds, large NBFCs, family trusts, and major financial institutions. Their inclusion brings stable, long-term capital and supports early demand in primary issuances. For retail investors, this means increased confidence, improved liquidity, and more accurate price discovery in real estate and infrastructure markets.

Author: Dr V Shunmugum, Partner – MCQube

This article was originally published in the Financial Express (https://www.financialexpress.com/business/how-reits-amp-invits-can-now-tap-into-more-retail-money-3982059/)