Imagine you have Rs 10,000 cash lying idle in your savings bank account. You want to invest. Opening a Fixed deposit is not a thing for Gen-Z, and the stock market feels like a roller coaster ride of many ups and downs. So, what if there is a middle path to achieve financial freedom, with having experts looking after your investments, tailored to your goals to achieve your “Financial Nirvana”.

Yes, Mutual Funds are the right investment vehicle, where you can park your surplus money and also enjoy returns that will outpace the inflation rate.

Understanding Mutual Funds:

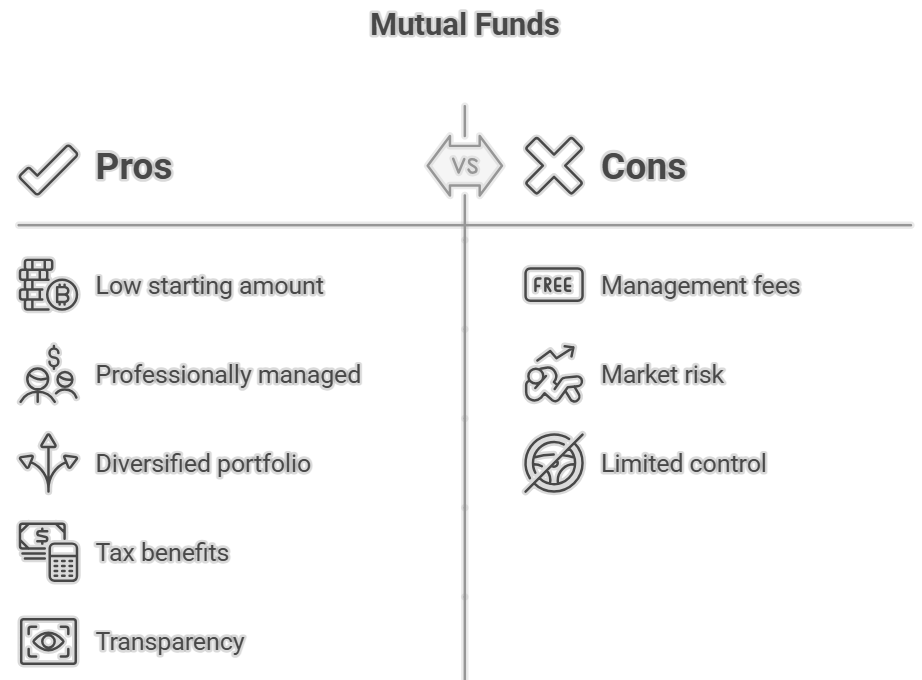

A Mutual fund is a financial product that pools the money of the investors. Fund Manager takes that money and invests it in a diversified portfolio of stocks, gold, bonds, or even the international market, depending on the objectives of the Fund. So, it provides an opportunity with lower risk instead of putting all your eggs in one basket (say, just one stock), your money gets spread across many. Each investor holds units of the fund, representing their proportionate share of the fund’s holdings. The value of these units is determined by the Net Asset Value (NAV), which fluctuates based on the performance of the underlying securities.

Types of Mutual Funds: Finding Your Investment Match

| Category | How It Feels | Ideal For |

|---|---|---|

| Equity Funds | Like a thrilling adventure — high risk, high reward | Long-term wealth creation |

| Debt Funds | A calm and steady ride | Risk-averse or conservative investors |

| Hybrid Funds | A mix of smooth and bumpy roads ️ | Those seeking a balance of risk and stability |

| ELSS (Tax-Saving Funds) | Like earning cashback while spending | Saving taxes while growing your investment |

Are Mutual Funds Risky?

Yes, market fluctuations can affect your mutual fund’s value. However, when you invest with a long-term perspective, mutual funds have historically outperformed traditional options like fixed deposits and savings accounts. Patience and planning are key.

Smart Tips Before You Invest

Final Word: Are Mutual Funds Really “Sahi”?

Absolutely — but only when selected wisely. Mutual funds are among the most efficient tools for long-term wealth generation. They’re not get-rich-quick schemes but disciplined vehicles for financial growth.

Let your mutual fund be your co-pilot — helping your money grow quietly while you sleep.

Vikas Garg

Assistant Manager

Centre for Content Creation (CCC)

National Institute of Securities Markets (NISM)

Volatility risk is well known, but that is usually less dangerous Retirees fear market volatility, and volatility is a risk…

For NISM, 2025 was defined by a renewed commitment to capacity building and investor education. Anchored by our mandate from…

The threats of money laundering (ML) and terrorist financing (TF) have grown exponentially due to the increasingly interconnected nature of…

© 2026 National Institute of Securities Markets (NISM). All rights reserved.