One of the earliest books I read on how to achieve financial independence was “Your Money or Your Life” by Vicki Robin and Joe Dominguez, which continues to be an international bestseller. It was here I stumbled across the term “the crossover point”. In the journey to financial independence the crossover point is a simple and powerful idea. It is the moment when your passive income surpasses your living expenses, signifying a profound shift from “when you work for money” to “when money works for you”. Getting to the crossover point could be a pivotal point in your life because it means that you can now be financially independent.

Living expenses encompass everything from housing, food, transportation, healthcare and entertainment. Today it has become easier to track your expenses as most payments are made digitally. Passive income refers to the money you earn from sources that require an initial investment and continue to generate steady income. As opposed to this, active income would be income earned from working a job or running a business. Passive income would include interest income from FDs and bonds, dividends from mutual funds and equity shares, rental income etc.

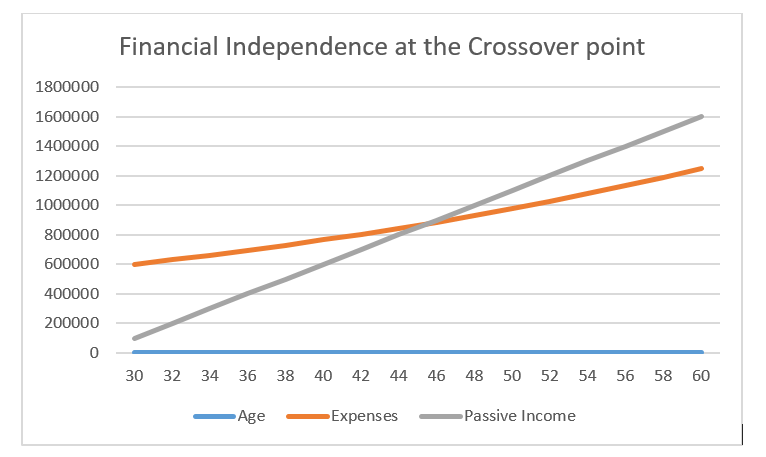

The point where your living expenses line and your passive income line intersect is your crossover point. The crossover point is significant as it offers immense psychological liberation because the pressure to work for money diminishes. This freedom leads to reduced stress and improved wellbeing. As Robin and Dominguez say in the book:

The crossover point provides us with our final definition of Financial Independence. At the crossover point, where monthly investment income crosses above monthly expenses, you will be financially independent in the traditional sense of the term. You will have a safe, steady income for life from a source other than a job.

The crossover point provides a powerful feedback loop for your financial strategy. It demonstrates that your investment efforts are being fruitful. It also signifies a shift in your financial engine. Before the crossover point your primary engine for wealth creation is your active income. After the crossover point it is your investment portfolio that is the dominant engine for wealth creation.

It is also important for you to be aware of how much you need to invest to exceed the crossover point – what your crossover assets should be. This is a fairly simple calculation, as illustrated below:

Investment Income = Crossover assets x Investment Returns

At the crossover point your investment income is equal to your expenses. Therefore, the above formula can be rewritten as:

Expenses = Crossover assets x Investment Returns or

Crossover assets = Expenses/Investment Returns

If your annual expenses are ₹ 6,00,000 (a monthly expense of ₹ 50,000) and you expected investment return is 8%, then the investable assets you will need to reach your crossover point is ₹6,00,000/8% or ₹75 lakhs.

The truly empowering shift in the pursuit of financial freedom will happen when you build up this investment corpus.

Author: Sashi Krishnan,

Director NISM

Volatility risk is well known, but that is usually less dangerous Retirees fear market volatility, and volatility is a risk…

For NISM, 2025 was defined by a renewed commitment to capacity building and investor education. Anchored by our mandate from…

The threats of money laundering (ML) and terrorist financing (TF) have grown exponentially due to the increasingly interconnected nature of…

© 2026 National Institute of Securities Markets (NISM). All rights reserved.