The Budget 2026 brought a huge setback for the Sovereign Gold Bond (SGB) investors.

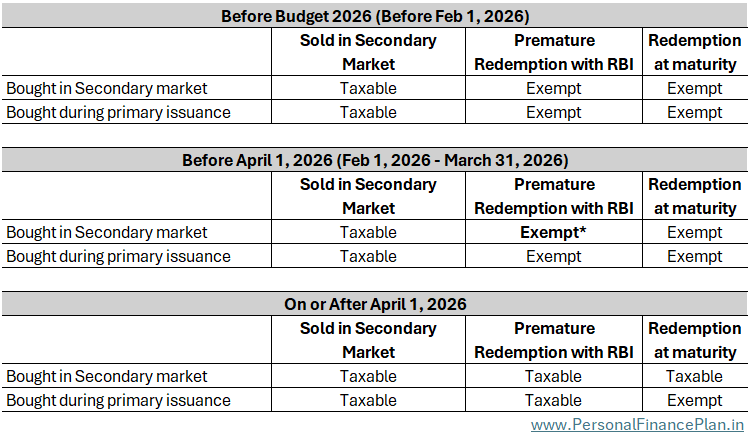

Before Budget 2026, all redemptions of SGBs with RBI (premature redemption or maturity) were not considered transfer and hence the gains were not taxable.

Now, that has changed. The Budget 2026 proposes to limit this tax exemption only for those bonds bought at the time of primary issuance and held continuously for 8 years until maturity.

In this post, let us see how this change affects you and if there is anything you can do to save on capital gains taxes from these bonds.

Before Budget 2026, any gains from the “redemption” of Sovereign gold bonds were exempt from tax. You can redeem bonds with RBI in 2 ways.

This was irrespective of how you purchased the bond. At the time of primary issuance (when the RBI first issued the gold bond). Or in the secondary market.

Now, the rule has been modified.

Going forward, the capital gains will be exempt from tax only if:

Both the conditions must be met for gains to be exempt from tax.

Capital gains will be taxable if

Primary issuance means “directly from RBI”. You bought when RBI initially issued the bond. You applied as you do for an IPO.

Secondary market means “buying on exchanges through your broker”. You must have placed a buy bid just like you do when you buy stocks.

https://x.com/deepeshraghaw/status/2017938768372871581?s=20

#1 If you bought SGBs during primary issuance, you do not have to worry. You can avoid paying taxes by simply holding the bonds until maturity.

#2 Selling your SGBs on the secondary market before April 1, 2026, won’t help save taxes. Because sales in the secondary markets are taxable even now. At your marginal tax rate for holding period < 1 year. At 12.5% for holding period > 1 year.

Yes, if your SGB is trading at a sharp premium, you can benefit from price deviation by selling in the secondary market. But you will not get any tax benefit and capital gains will be taxed.

#3 Buying SGBs in the secondary market won’t help either. Why? Because if you buy SGB in the secondary market, you have no way out. Your gains on maturity, redemption during premature withdrawal window, or secondary market sales will be taxed as capital gains.

#4 As I see, the only SGBs (that were bought in the secondary market) that are still exempt from capital gains are those:

*The Section 47 of the Income Tax Act, 1961 and Section 70 of the Income Tax Act, 2025 make no distinction between premature redemption and redemption on maturity. OR how the gold bonds were purchased (primary issuance or secondary market). Hence, any redemption with RBI should be exempt from taxes. The amendment to Section 70 (brought in Budget 2026) removes the tax-exemption for premature withdrawals or for secondary market purchases. However, this amended clause comes into effect from April 1, 2026. Therefore, any premature withdrawal made before April 1, 2026, should be exempt from taxes too, even if you bought in the secondary market.

| Section 70 (Transactions not regarded as Transfer) Clause 1(x) |

|

|---|---|

| Before Budget 2026 | Amended to |

| of Sovereign Gold Bond issued by the Reserve Bank of India under the Sovereign Gold Bond Scheme, 2015, by way of redemption, by an individual | by way of redemption, of Sovereign Gold Bond issued by the Reserve Bank of India under the Sovereign Gold Bond Scheme, 2015 or any subsequent Sovereign Gold Bond Scheme, if held by an individual from the date of original issue till maturity |

However, there is spanner in the works. In the FAQs on Budget 2026 issued by the Income Tax department, I found the following on Page no. 54 of this FAQ document.

Q.4 Will the exemption under section 70(1)(x) of the Income-tax Act, 2025 apply to Sovereign Gold Bonds acquired through secondary market transactions?

Ans: No, the exemption shall not apply to Sovereign Gold Bonds acquired through transfer or purchase in the secondary market. The exemption is restricted to bonds subscribed to by an individual at the time of original issue. This was also clarified by the Department of Economic Affairs in its OM dated 06.12.2022.

Q.5 Will this exemption be available in cases of premature redemption of Sovereign Gold Bonds?

Ans: No, the exemption shall apply only where the Sovereign Gold Bond is held continuously until redemption on maturity. Premature redemption, even after completion of the prescribed lock-in period, shall not be eligible for exemption.

With this response, it seems that the Income Tax Department gave this clarification (that secondary market purchases are not exempt from tax) over 3 years ago. I could not find the aforementioned memo online. In any case, my understanding is that an internal memo of the Department of Economic Affairs cannot override an act passed by the Parliament of India.

Note: This is a complex tax issue. I am not a tax expert. Please consult your tax advisor before acting.

If you go by my assessment that premature redemption (for secondary market purchases) is still exempt before April 1, 2026, the next question is which are those SGBs that have premature redemption window before April 1, 2026.

For such SGBs, you can exercise the option of premature redemption and avoid paying taxes (even if you bought in the secondary market).

Only 4 SGBs have such windows available. Information source: NSDL

| SGB issue | ISIN | Bond Maturity | Coupon Payment Date | Dates of submitting premature redemption request |

|---|---|---|---|---|

| SGB 2020-21 SERIES VI | IN0020200195 | September 2028 | March 7 | Feb 5, 2026, to Feb 25, 2026 |

| SGB 2020-21 SERIES XII | IN0020200427 | March 2029 | March 9 | Feb 6, 2026, to Feb 27, 2026 |

| SGB 2019-20 SERIES X | IN0020190552 | March 2028 | March 11 | Feb 7, 2026, to March 2, 2026 |

| SGB 2019-20 Series IV | IN0020190115 | September 2027 | March 17 | Feb 13, 2026, to March 7, 2026 |

Hence, if you have bought any of the above 4 bonds from the secondary market, this could be your chance to avoid paying taxes on gains from these bonds.

If you have capital losses from sale of any asset, then you can use such capital loss to set off capital gains from sale/redemption of Sovereign gold bonds.

This article was originally published in Personal Finance Plan.

Author: Deepesh Raghaw, SEBI Registered Investment Advisor and Founder of PersonalFinancePlan.in

The Budget 2026 brought a huge setback for the Sovereign Gold Bond (SGB) investors. Before Budget 2026, all redemptions of…

Volatility risk is well known, but that is usually less dangerous Retirees fear market volatility, and volatility is a risk…

For NISM, 2025 was defined by a renewed commitment to capacity building and investor education. Anchored by our mandate from…

© 2026 National Institute of Securities Markets (NISM). All rights reserved.