Numbers Tell a Story: Why Asset Diversification Matters

Numbers have a way of bringing perspective to investing. They cut through opinions and reveal what performance truly looks like. In India, most investment conversations still revolve around equities — stock picks, index levels, and daily market momentum dominate the narrative. Bonds, on the other hand, often stay in the background. Yet, when data speaks, it clearly shows why this “quiet” asset class is so critical for balanced investing.

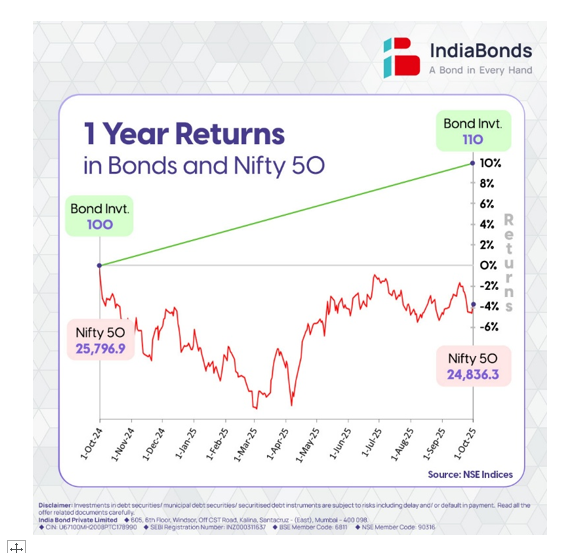

A Look at the Last Year

Over the past 12 months, the contrast between equity and bond returns has been hard to ignore. Based on NSE data, the Nifty 50 delivered a negative return of –3.72%, while a 10% corporate bond (rated AA–/A+) offered a steady +10% return.

| Asset Class | Value at Start (Oct ’24) | Value after 1 Year (Oct ’25) | Total Return |

|---|---|---|---|

| Nifty 50 | 25,796.9 | 24,836.3 | –3.72% |

| 10% Corporate Bond | 100 | 110 | +10% |

While equities saw short-term volatility and downward corrections, bond investors enjoyed consistent growth. It’s a reminder that stability often wins when markets turn uncertain — and that steady compounding can quietly outperform speculation.

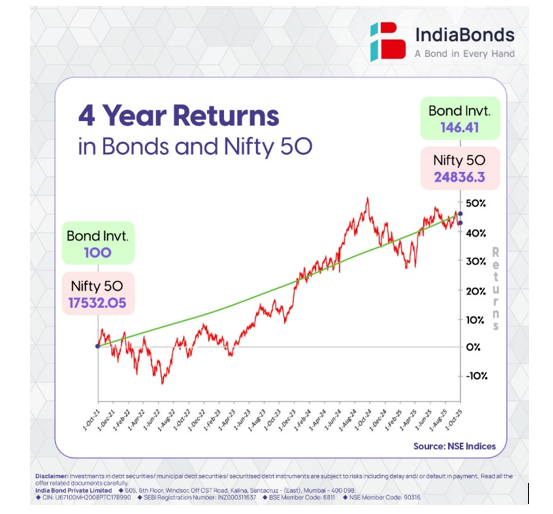

A Longer Lens: The 4-Year Comparison

Zooming out gives a clearer picture of how asset classes behave across cycles. Over the last four years, both equities and bonds have delivered strong returns, but the journey to those returns has been very different.

| Asset Class | Value at Start (Oct ’21) | Value after 4 Years (Oct ’25) | Total Return |

|---|---|---|---|

| Nifty 50 | 17,532.05 | 24,836.3 | +41.6% |

| 10% Corporate Bond | 100 | 146.41 | +46.4% |

(Bond returns assume reinvested coupons; taxes and costs excluded.)

Even over a four-year period, high-quality corporate bonds have not only kept pace with equities but slightly outperformed them — and with significantly lower volatility with peace of mind. The equity curve shows sharp peaks and dips, while bond returns move upward in a straight, predictable line. This steadiness helps investors stay invested through market cycles instead of reacting to every correction

Putting Returns in Context

Equities remain an important engine for long-term growth, but their journey is rarely smooth. In contrast, high-quality corporate bonds offer predictable income and lower price volatility, allowing investors to stay invested without panic or second-guessing the market.

Consider this:

These numbers reinforce one fundamental investing truth — diversification matters more than timing and it’s not about choosing one over the other. A blend of growth-oriented equities and income-generating bonds creates resilience through changing market phases.m

Role of Bonds in a Balanced Portfolio

For a long time, investing in bonds in India meant navigating complex paperwork or limited options. That has changed. Today, Online Bond Platform Providers (OBPPs) have made it possible to invest in bonds digitally with transparent pricing, quick settlement & easy access.

This accessibility has brought fixed income into the mainstream, allowing retail investors to enjoy what institutions have known for decades: bonds are essential for wealth preservation and portfolio balance.

Globally, bonds and equities are seen as complementary pillars. When one faces volatility, the other cushions it. That’s how long-term portfolios survive cycles and keep compounding steadily.

In summary: Numbers don’t lie — they remind investors that balance beats extremes. The past year shows how bonds quietly delivered positive returns while equities saw short-term dips. As India’s financial ecosystem matures, investors have more opportunities than ever to diversify intelligently.

A Bond in Every Hand.

Author: Mr. Vishal Goenka – Co-Founder IndiaBonds

The Union Budget 2026, presented by Finance Minister Nirmala Sitharaman, marks a watershed moment in India’s economic narrative. Dubbed the…

The Budget 2026 brought a huge setback for the Sovereign Gold Bond (SGB) investors. Before Budget 2026, all redemptions of…

Volatility risk is well known, but that is usually less dangerous Retirees fear market volatility, and volatility is a risk…

© 2026 National Institute of Securities Markets (NISM). All rights reserved.