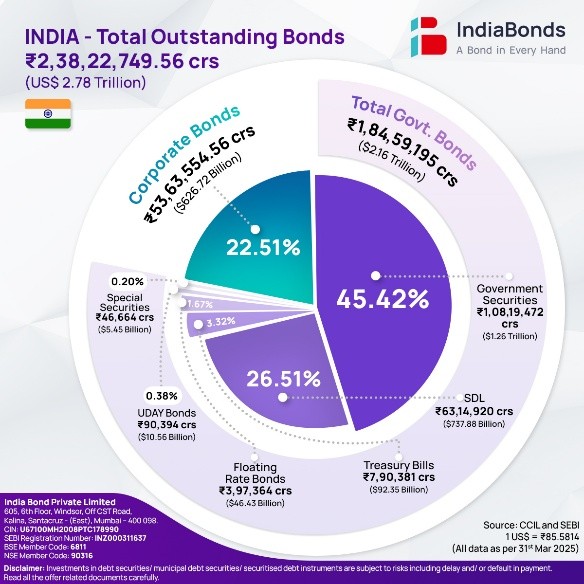

As India charts its course towards Viksit Bharat, by 2047, the sophistication and depth of its financial markets are paramount. In this journey, the Bond market is emerging from the shadows to take center stage. Once considered the exclusive domain of large institutions, it is now undergoing a profound transformation. The Indian Bond market has reached a significant milestone, expanding to approximately ₹238 lakh crores (US$ 2.78 trillion) as of March 31, 2025. As the Reserve Bank of India maintains a steady policy stance and encourages corporates to tap into capital markets, it is an opportune moment to analyze the forces propelling this expansion and the structural shifts reshaping our fixed-income landscape.

The Corporate Bond Market Progression

While the overall market demonstrated impressive growth, the Corporate Bond segment was a standout performer, acting as a powerful engine for this expansion. The Indian Corporate Bond market now stands at ₹53.64 lakh crores (US$ 627 billion), constituting 22.51% of the total bond market. This accelerated growth is not incidental; it is the result of progressive regulations by SEBI and a lot of other converging factors.i

Evolving Dynamics in Government Securities

India’s borrowing is shifting toward longer‑term bonds. The Centre has about ₹108 lakh crore of G‑Secs outstanding and states have around ₹63.15 lakh crore of State Development Loans (SDLs). Short‑term Treasury Bills are roughly ₹7.9 lakh crore. In plain terms, the government is locking in more long‑term money to cut refinancing risk and to fund projects that take years. The growth in SDLs shows states are using capital markets more directly, which builds accountability. For sizing the bond market, this means the long‑end investible universe is larger, trading in key benchmarks is improving, and the yield gap between Centre and states is now a central input when choosing bonds.

The Road Ahead

The outlook for the corporate bond market remains decidedly bullish. The core conditions that fueled last year’s growth are expected to persist. However, beyond these existing tailwinds, several future catalysts are poised to accelerate this growth trajectory even further.

The trend of retail participation shows no signs of slowing. According to a BSE report, the number of transactions in the retail segment grew by an exponential 327% last year, and this momentum has only accelerated in the current fiscal, a trend we have witnessed firsthand on our platform. This deepening of the market is crucial for its long-term health and vibrancy.

A pivotal moment for the Indian bond market will be its inclusion in major global bond indices. This development is expected to attract substantial passive inflows from foreign institutional investors, enhancing market liquidity and stability. More importantly, it will align our market infrastructure, trading practices, and regulatory standards with global best practices, further boosting international confidence.

Conclusion

In conclusion, the Indian bond market is in the midst of a profound structural evolution. It is transitioning from a wholesale-dominated market to a more inclusive and dynamic ecosystem. Driven by regulatory innovation, macroeconomic tailwinds, and the unstoppable force of retail participation, it is becoming a more transparent and accessible arena for both issuers and investors. The journey towards “a bond in every hand” is not just a slogan; it is a strategic imperative for building a resilient and self-sufficient economy. This transformation is well underway, strengthening India’s capital markets for a new era of growth and prosperity.

Author: Mr. Vishal Goenka, Co-Founder, IndiaBonds

Volatility risk is well known, but that is usually less dangerous Retirees fear market volatility, and volatility is a risk…

For NISM, 2025 was defined by a renewed commitment to capacity building and investor education. Anchored by our mandate from…

The threats of money laundering (ML) and terrorist financing (TF) have grown exponentially due to the increasingly interconnected nature of…

© 2026 National Institute of Securities Markets (NISM). All rights reserved.