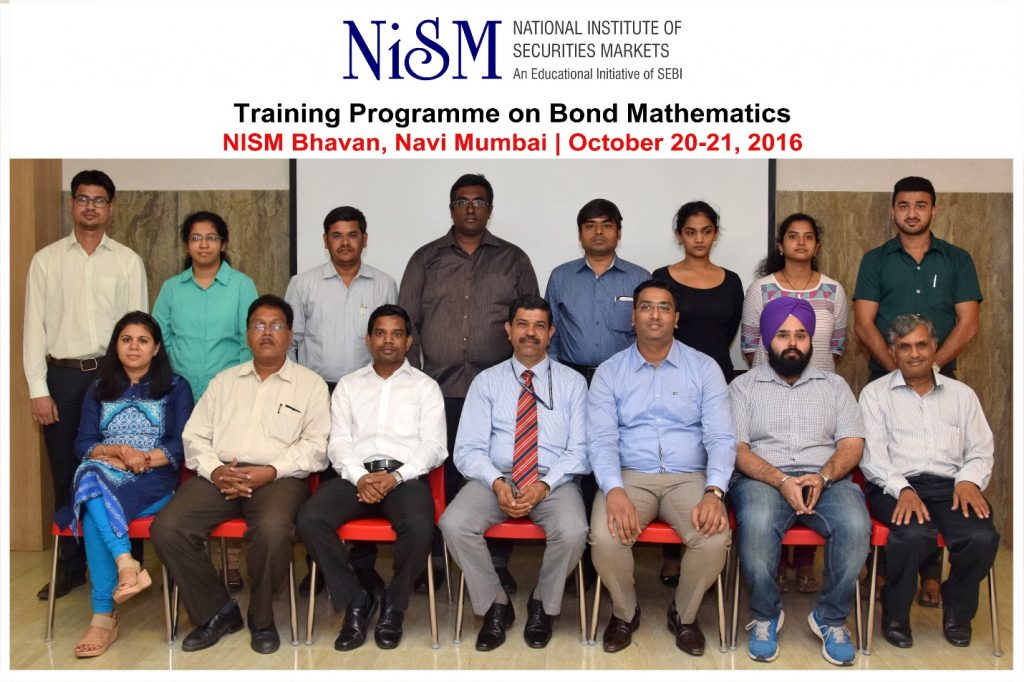

The Training Programme on ‘Bond Mathematics’ was held during October 20-21, 2016 at NISM Bhavan, Vashi, Navi Mumbai.

The program was designed to begin with an introduction to Indian fixed income securities market and fundamental concepts such as time value of money, interest or discount rates, compounding conventions, etc. The rest of the sessions were more focused on exploring various concepts that are applied to the calculation of yields, duration, convexity, prices, accrued interest, etc. for treasury securities, corporate bonds and fixed income futures contracts.

The topics/areas covered in the programme were Introduction to Fixed Income Securities – terms, bond indenture, types, time value of money, etc., Duration, Convexity, Yield Curve Analysis, Bootstrapping Spot and Forward Rates, Pricing and valuation of Fixed Income Securities, Yield Measures, Money Market Industry in India, Analysis of Fixed Income Securities, and Trading Strategies, SLR Maintenance, Compliance and Fixed Income Derivatives.

Hands-on practice on excel were done in each areas of bond mathematics.

The participants for the programme were from different institutions like Stock Holding Corporation of India Ltd, The Sarvodaya Sahakari Bank Ltd, FIS Global, VES Institute of Management Studies and Research, Chetana’s Institute of Management & Research, IFMR Capital, Mahindra and Mahindra Financial Services Ltd, etc.

Volatility risk is well known, but that is usually less dangerous Retirees fear market volatility, and volatility is a risk…

For NISM, 2025 was defined by a renewed commitment to capacity building and investor education. Anchored by our mandate from…

The threats of money laundering (ML) and terrorist financing (TF) have grown exponentially due to the increasingly interconnected nature of…

© 2026 National Institute of Securities Markets (NISM). All rights reserved.